COVID-19 impact: Investment banking activity slows down in 2020

COVID-19 impact: Investment banking activity slows down in 2020

BusinessToday.In

- Aug 30, 2020,

- Updated Aug 31, 2020 8:43 AM IST

- 1/6

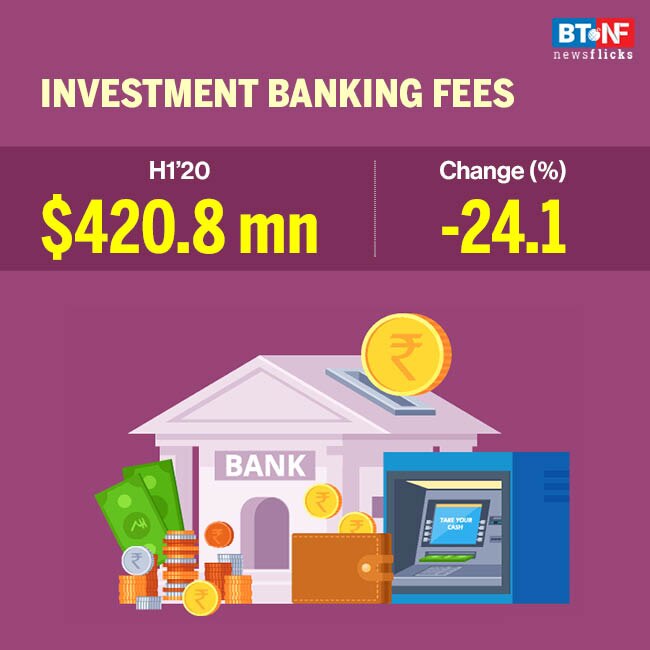

Investment banking activities in India generated $420.8 million during the first half of 2020, down 24.1 per cent from the same period last year. It's also the lowest first half since 2016.

- 2/6

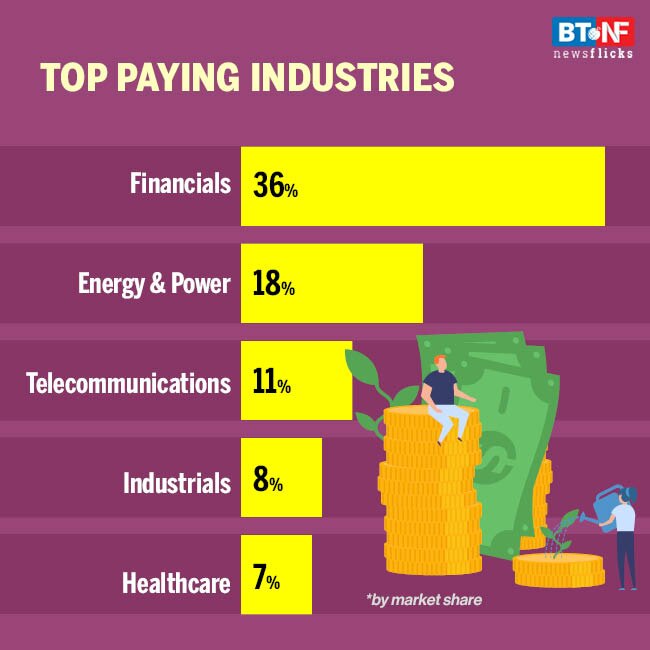

The top investment banking fee paying industries were financial sector with 36 per cent market share, followed by energy and power with 18 per cent share, telecommunications (11 per cent), industrials (8 per cent) and healthcare (7 per cent).

- 3/6

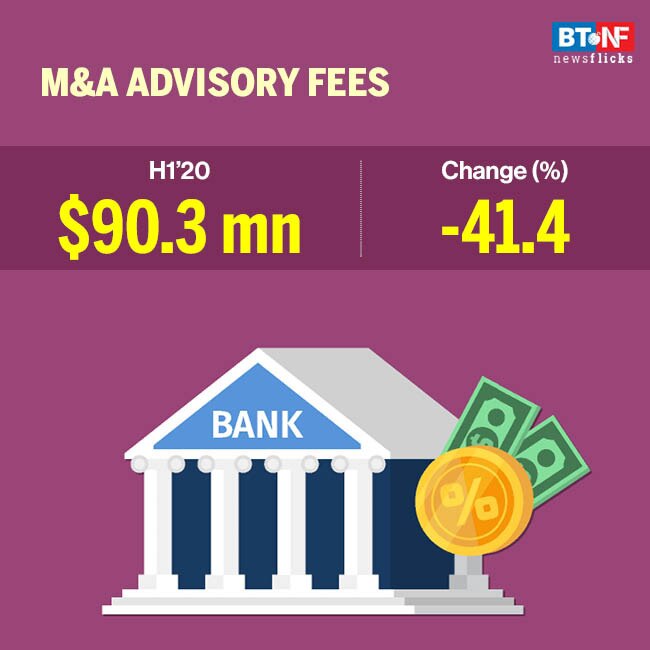

Completed M&A advisory fees totalled $90.3 million in H1 2020, registering its biggest decline of 41.4 per cent (YoY).

- 4/6

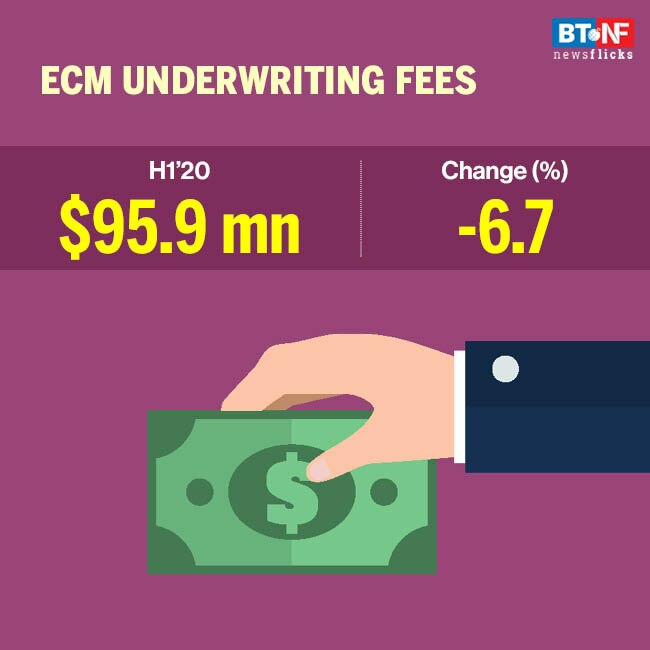

Equity capital market (ECM) underwriting fees reached $95.9 million, a 6.7 per cent drop from the same period in 2019.

- 5/6

Debt capital markets (DCM) underwriting fees totalled $118.8 million, down 19.2 per cent from a year ago. Syndicated lending fees fell 23.1 per cent from last year and generated $115.8 million.

- 6/6

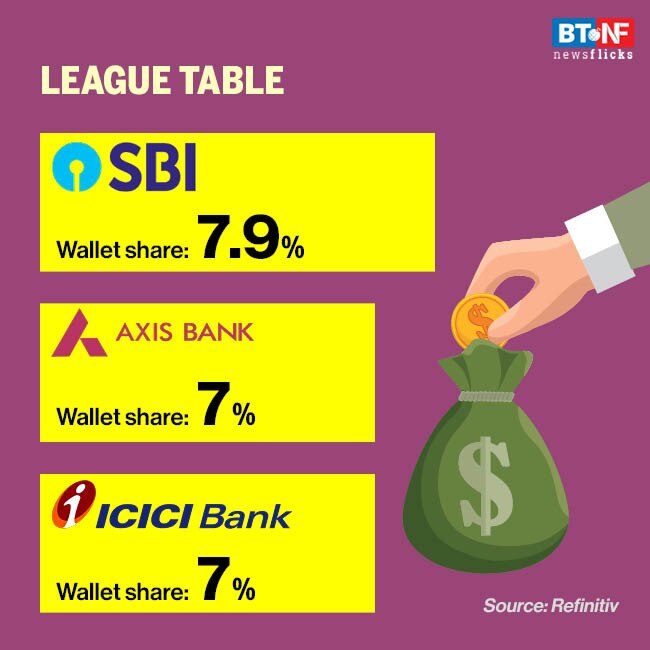

State Bank of India took the top spot in India's investment banking fee league tables with 7.9 per cent wallet share, and $33.3 million in related fees. Axis Bank and ICICI Bank both registered 7.0 per cent wallet share.

Story: Shivani Sharma

Design: Pragati Srivastava