How coronavirus changed India's digital spending habits

How coronavirus changed India's digital spending habits

BusinessToday.In

- Apr 28, 2020,

- Updated Apr 28, 2020 8:04 PM IST

- 1/8

Overall digital payment transactions have dropped 30% during the 30 day lockdown during March 24 - April 23 as per data compiled from transactions carried out on Razorpay platform.

- 2/8

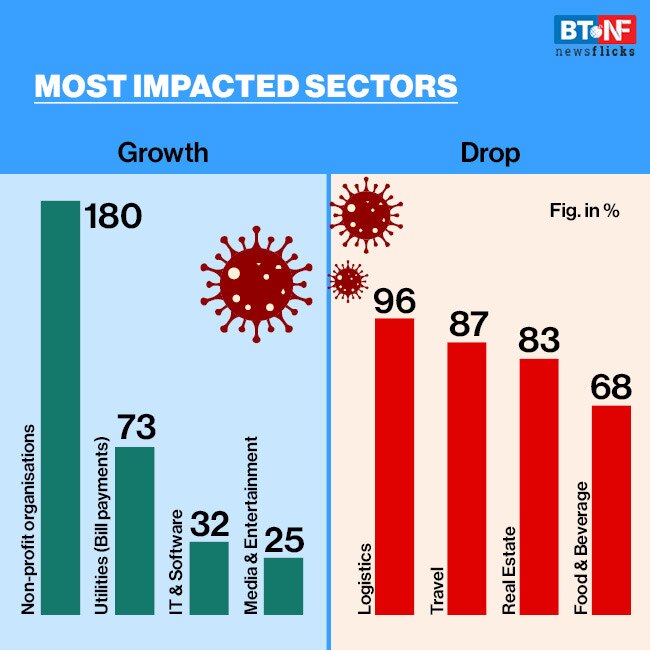

To support India's fight against Coronavirus, citizens came forward to help the affected through online donations. As per Razorpay, in the 30 days of lockdown an increase of 180% in the donations towards NGOs were recorded.

- 3/8

Amid lockdown during March 24 - Apr 23, sectors such as Travel, Real Estate, and Food & Beverage (F&B) suffered the most. As per transactions carried out on Razorpay a decline by 87%, 83% and 68% respectively, was recorded as compared to the pre-lockdown period.

- 4/8

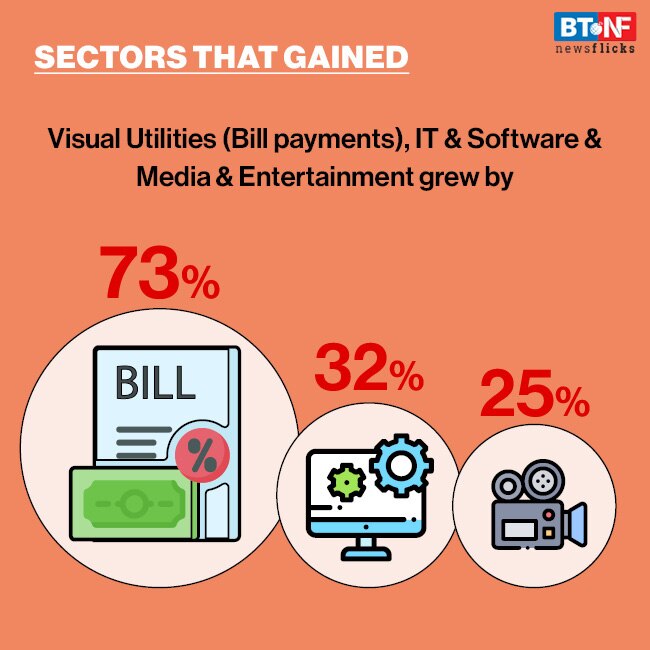

During lockdown, as people stayed indoors, some sectors also witnessed huge rise in demand as Utilities (Bill Payments), IT & Software and Media & Entertainment grew by 73%, 32% and 25% respectively.

- 5/8

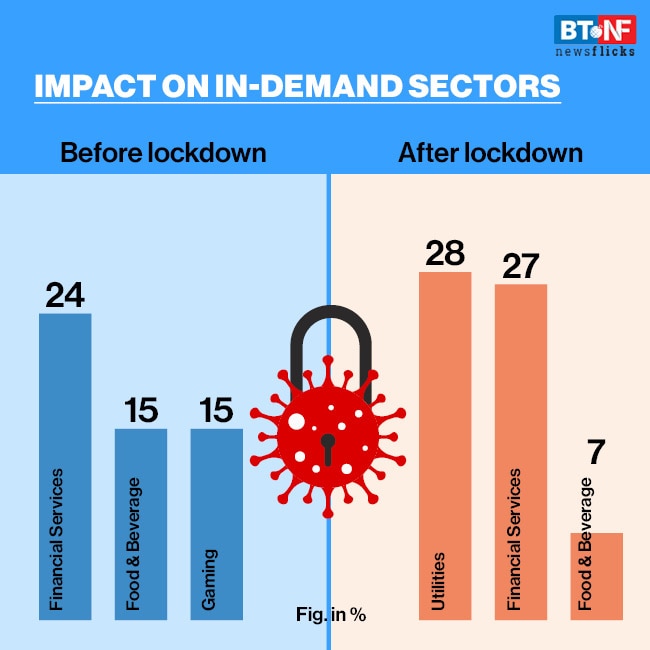

On Razorpay's platform, the top 3 sectors saw some reordering after lockdown was implemented. The highest transactions were done for utilities followed by Financial services that saw a marginal rise in demand. The share of Food and beverages dropped while Gaming dropped out from the top 3 sectors rankings.

- 6/8

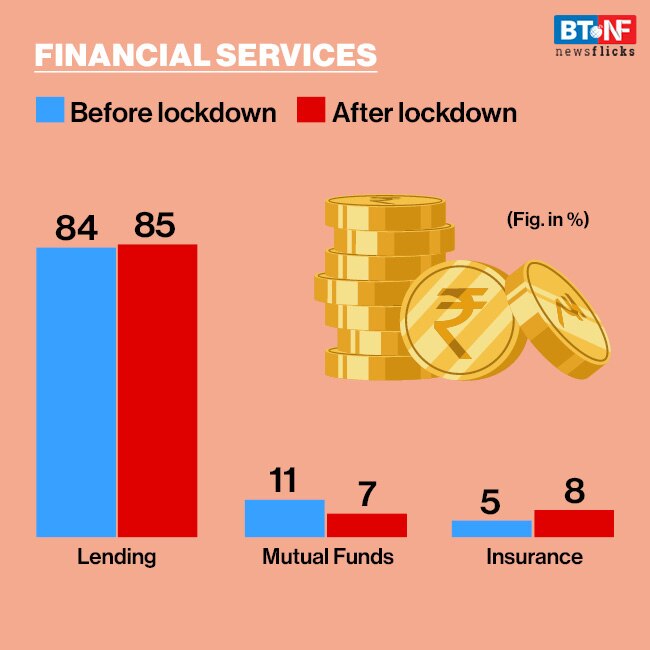

Post lockdown, lending transactions increased by a percentage. Online investments into Mutual funds through the Razorpay platform dropped substantially while demand for insurance products nearly doubled.

- 7/8

During the 30 day lockdown period, some sectors gained while some sectors lost. Sectors that gained demand are Non-Profit organisation, Utilities, Information Technology and Media. While the sectors that lost demand were logistics, travel, food & beverage and real estate.

- 8/8

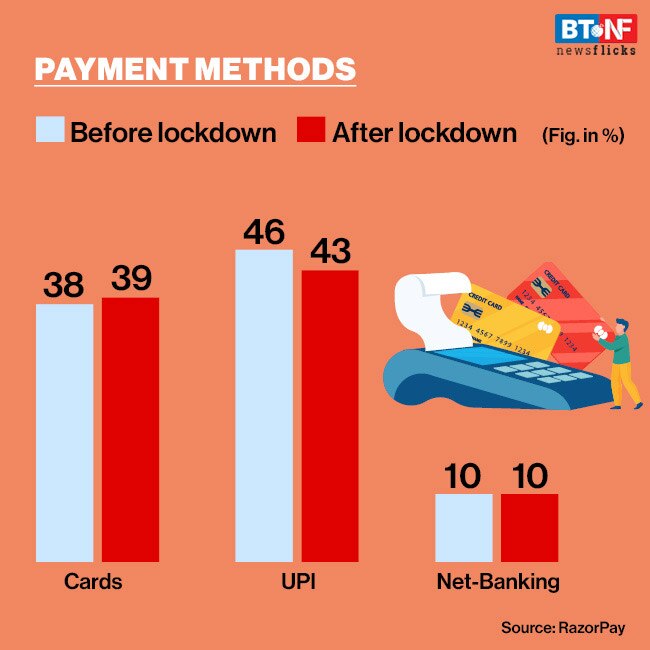

The payment methods used by consumers also show a change during the lockdown as payments by cards (debit & credit) increased, UPI transactions fell while similar levels of transactions through net-banking occurred.