Rich Indians to get 87% richer in 5 years

Rich Indians to get 87% richer in 5 years

BusinessToday.In

- Dec 18, 2018,

- Updated Apr 22, 2019 5:26 PM IST

- 1/9

India is on the brink of a quantum leap in wealth generation with the number of wealthy Indians and their affluence expected to rise by an astonishing 87% over the next five years, a study by IIFL Wealth Management and Wealth-X showed.

- 2/9

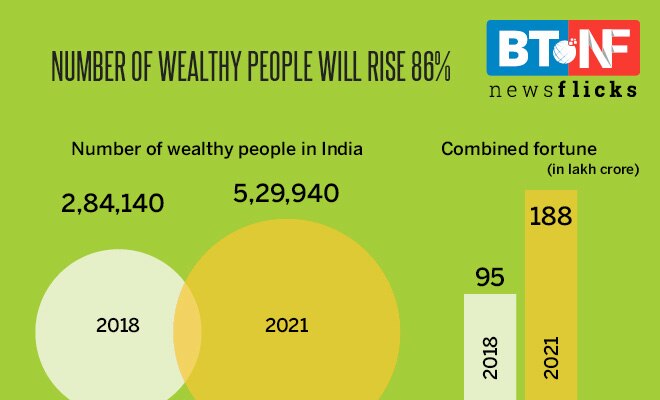

The Indian economy is home to 2,84,140 wealthy individuals with a combined fortune of Rs 95 lakh crore. India's wealthy will rise to Rs 188 lakh crore by 2021 and the number of wealthy people will rise 86% to reach just over half a million to 5,29,940, according to findings from the IIFL Wealth Management Wealth Index 2018 report.

- 3/9

India's 4,470 ultra-high net worth individuals (UHNWIs) are richer than their global counterparts, holding an average wealth of Rs 865 crore compared with the average equivalent of Rs 780 crore for the typical global UHNWI, according to the study.

- 4/9

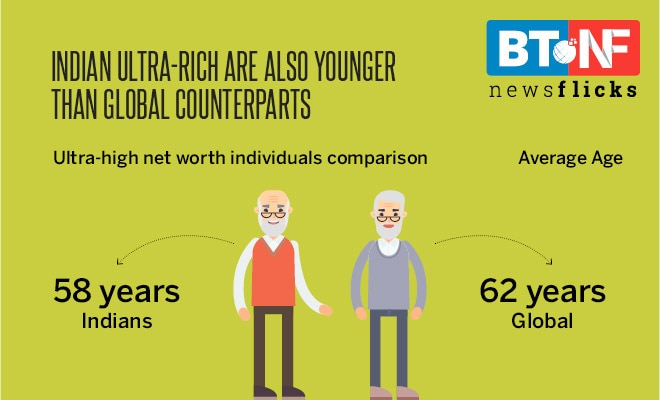

India's UHNWIs are also slightly younger than their global counterparts, with an average age of 58 compared with 62 globally.

- 5/9

India's high net worth (HNW) population growth of 40% over the past five years has eclipsed that of its rivals in economies elsewhere in the world, placing India in a league of its own" said Karan Bhagat, CEO of IIFL Wealth Management. "By comparison, the global HNW population and its wealth grew by 3.2% and 4.2%, respectively over the same period".

- 6/9

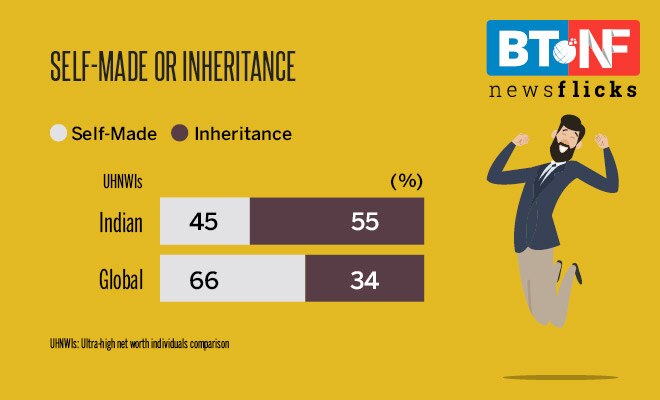

While 45% of Indian UHNWIs are self-made, 66% of their global counterparts made their own fortunes. About 55% of India's UHNWIs relied on some form of inheritance compared with the global UHNW average of 34%.

- 7/9

India is ranked fourth in the world for the number of new wealthy individuals joining the ranks of the rich, standing behind economic giants like US, Japan and China.

- 8/9

As India's super rich head the wealth league table, their impact will be magnified around the world as they choose increasingly to invest overseas in business and property or to be educated abroad, stated the study. Their luxury spending power is set to explode from London and New York to Paris and Dubai. The Indian wealth factor has only just begun to come into play.

- 9/9

Compared with their peers overseas, the Indian ultra-rich hold a smaller proportion of their wealth in liquid assets, with one third invested in their primary businesses.