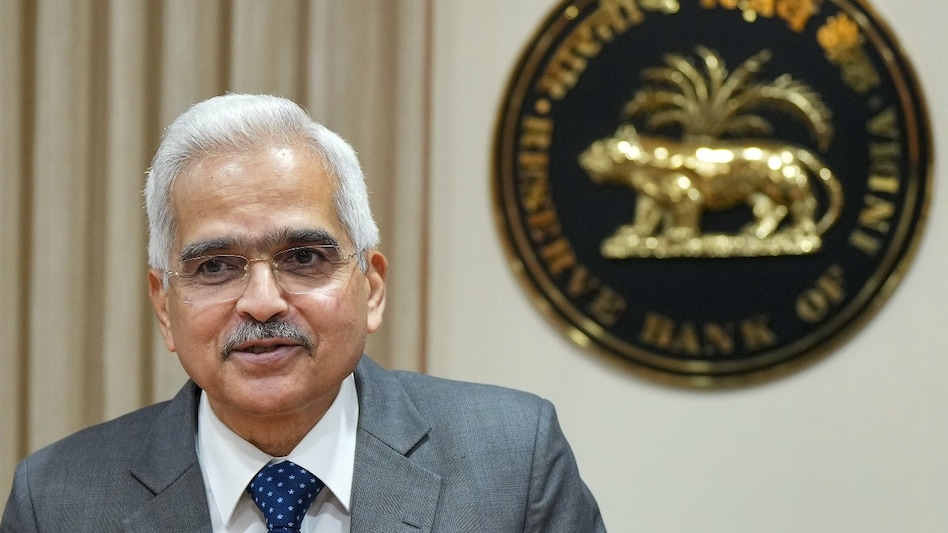

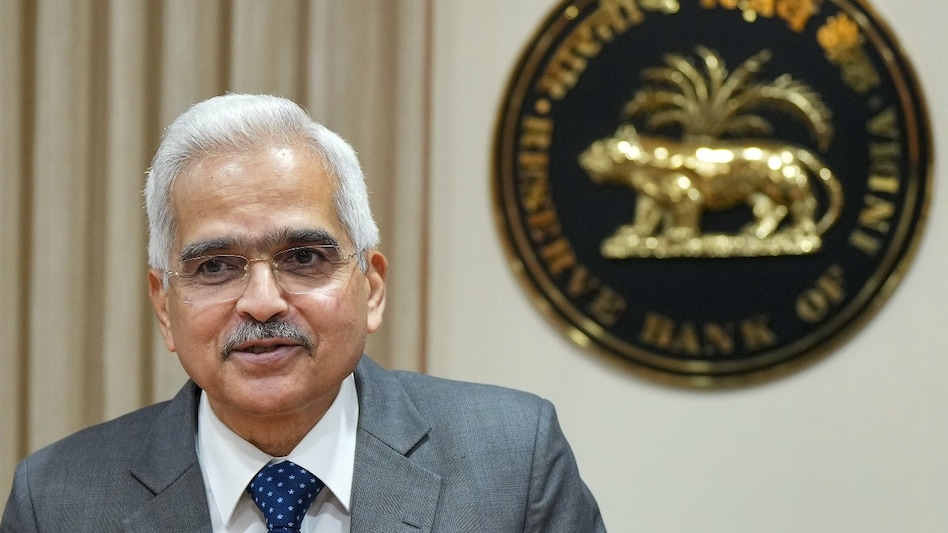

RBI Gov Shaktikanta Das bats for expansion of RTGS to dollar, euro transactions

RBI Gov Shaktikanta Das bats for expansion of RTGS to dollar, euro transactions RBI Gov Shaktikanta Das bats for expansion of RTGS to dollar, euro transactions

RBI Gov Shaktikanta Das bats for expansion of RTGS to dollar, euro transactionsReserve Bank of India Governor Shaktikanta Das called for reducing time and cost of overseas remittances, as well as expanding real-time gross settlement (RTGS) to settle transactions in major trade currencies such as dollar, euro, and pound. He also underscored the potential of Central Bank Digital Currency (CBDC) to facilitate cross-border payments.

“Remittances are the starting point for many emerging and developing economies, including India, to explore cross-border peer-to-peer (P2P) payments. We believe there is immense scope to significantly reduce the cost and time for such remittances,” he said in his keynote address at the conference on 'Central Banking at Crossroads'.

He further said, “India is one of the few large economies with a 24x7 RTGS system. The feasibility of expanding RTGS to settle transactions in major trade currencies such as USD, EUR and GBP can be explored through bilateral or multilateral arrangements. India and a few other economies have already commenced efforts to expand linkage of cross- border fast payment systems both in the bilateral and multilateral modes.”

Governor Das said that CBDCs is an area where India has the potential to facilitate efficient cross-border payments. “India is one of the few countries that have launched both wholesale and retail CBDCs. Programmability, interoperability with the UPI retail fast payment system and development of offline solutions for remote areas and underserved segments of the population, are some of the value added services which we are now experimenting as part of our CBDC pilot,” he said.

Harmonisation of standards and interoperability would be important for CBDCs for cross-border payments and to overcome the serious financial stability concerns associated with cryptocurrencies, he said. Countries might prefer to design their own systems as per the domestic considerations, a challenge that can be overcome by developing a plug-and-play system that allows replicability of India’s experience.

The RBI Governor also raised concerns over misuse of Artificial Intelligence in the banking space saying it could lead to more cyber attacks and data breaches. "Banks and other financial institutions must put in place adequate risk mitigation measures against all these risks. In the ultimate analysis, banks have to ride on the advantages of AI and Bigtech and not allow the latter to ride on them," he said.