(Photo: Reuters)

(Photo: Reuters) (Photo: Reuters)

(Photo: Reuters)Anil Ambani Group company Reliance Power (RPower) signed an initial agreement in New Delhi on Sunday to acquire all the three hydroelectric power plants of Jaiprakash Associates Limited. SBI Capital Markets is acting as adviser for the proposed transaction.

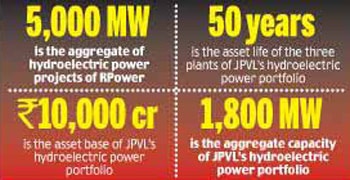

Reliance CleanGen Ltd (RCL), a 100-per cent subsidiary of Reliance Power Limited , and Jaiprakash Power Ventures Limited (JPVL), a subsidiary of Jaiprakash Associates Limited (Jal), have assigned an exclusive memorandum of understanding for the 100-per cent acquisition by RCL of the entire hydroelectric power portfolio of JPVL, the company said in a statement.

Jal intends to utilise the entire proceeds of the proposed transaction to reduce its outstanding debt, and thereby deleverage its consolidated balance sheet, RPower said. The completion of the proposed transaction would make RPower the largest provider of hydroelectric power in the private sector in India, it added.

RPower has hydroelectric power projects aggregating over 5,000 MW under development, of which 4,200 MW are located in Arunachal Pradesh, 700 MW in Himachal Pradesh and 400 MW in Uttarakhand.

The development comes merely four days after an Abu Dhabi-led consortium pulled out of a $ 1.6 billion deal to buy two hydroelectric power plants from JPVL dealing a blow to the Indian Group's efforts to cut its debt. Abu Dhabi National Energy Co (Taqa) told Jaiprakash Power that the decision was due to a change in the Group's business strategy and priorities, Jaiprakash had said in a stock exchange filing on Thursday.

Taqa had stated that it is exiting the deal, which was made public in March, because of "a change in strategy". Taqa is liable to pay a "break fee", Jaiprakash Power had said on Thursday without divulging any details about the amount involved.