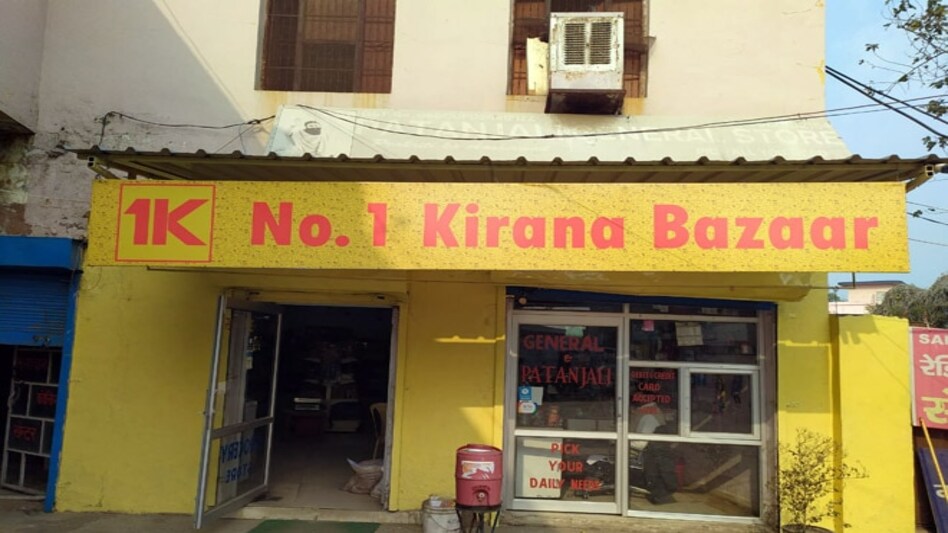

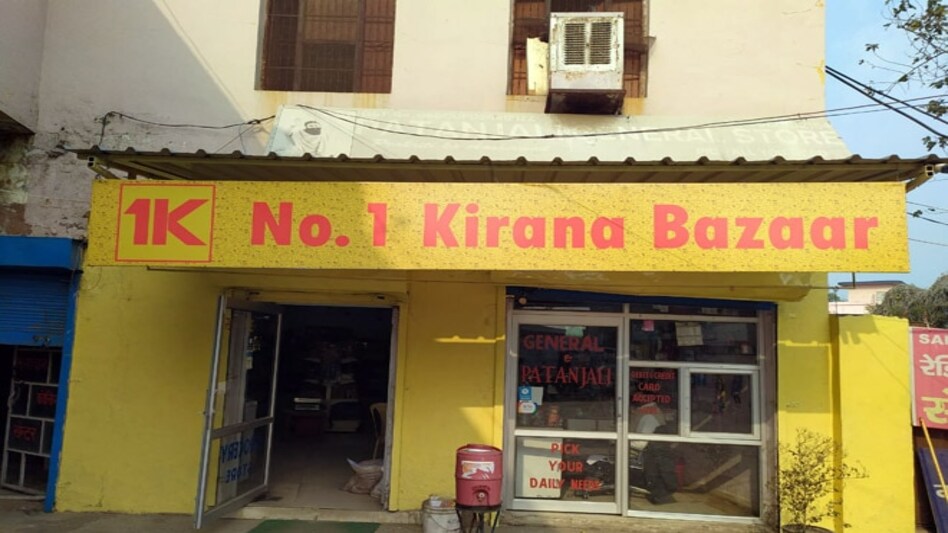

Image credit: 1K Kirana Bazaar/ Facebook

Image credit: 1K Kirana Bazaar/ Facebook Image credit: 1K Kirana Bazaar/ Facebook

Image credit: 1K Kirana Bazaar/ FacebookHyperlocal omni-channel grocery chain 1K Kirana Bazaar has set its sights on creating its own brand of attas, pulses and spices, joining the likes of Reliance Retail, BigBasket and Grofers who are all trying to carve a slice for themselves in the $600 billion grocery market largely dominated by giants like ITC and HUL.

"Private labels are the largest profit pools. Every retailer will be looking at creating their own private label. You just need to be picky about the category where you want to do that," said CEO and co-founder Kumar Sangeetesh.

India's biggest company Reliance Industries has already been stocking up the shelves of Reliance Retail with its own less expensive private grocery labels alongside more popular brands. Online grocery leader BigBasket has a large portfolio of private brands. Rival Grofers has at least eight of its own brands, while e-commerce giants Amazon and Flipkart also have their own private brands. Between them, they sell an array of products ranging from packaged milk to snack items to instant food and essentials.

ALSO READ: Rural distribution company StoreKing to launch modern retail stores in rural India

"Staples are the largest category we are looking at because that's where brand affinity is very low. Tomorrow, retailers will sell rice, pulse, dry fruits, spices and other things mostly as in-house brands," said Sangeetesh.

To be sure, 1K Kirana Bazaar is eyeing the non-urban and smaller towns with its current primary customer base being the smaller districts of Delhi-NCR. Meanwhile, intense competition in online groceries has been playing out in larger cities mostly, accelerated by pandemic-fuelled online buying.

Sangeetesh said staples also tie up well with 1K Kirana Bazaar's target of non-urban grocery buyers, with the category accounting for 50-55 per cent of the grocery consumption mix in rural pockets because that's where people put more money in. "In urban areas, staples account for 35-40 per cent of the mix."

The brand, which will work with third-party manufacturers and vendors, has started with its own brand of pulses. "We are also looking at other categories like atta, rice and spices," he said.

ALSO READ: HUL, Marico, ITC, Godrej Consumer say prepared to tackle COVID-19 disruptions

Set up in 2018, the chain has tied up with more than 100 small stores on commission basis. They are involved in the product assortment mix, inventory and technological enablement. An app is used to engage with customers, but actual sales happen at the physical store.

Their target is to reach 1,000 stores by September 2022. They have raised a total sum of $1.5 million (around Rs 11 crore) so far.