Revenue Secretary Tarun Bajaj

Revenue Secretary Tarun Bajaj

Revenue Secretary Tarun Bajaj

Revenue Secretary Tarun BajajIndia's gross tax collections soared to a record high of Rs 27.07 lakh crore in the financial year 2021-2022 as mop-up from income, corporate taxes, customs and GST jumped, taking the tax-to-GDP ratio to the highest in 23 years, Revenue Secretary Tarun Bajaj said on Friday.

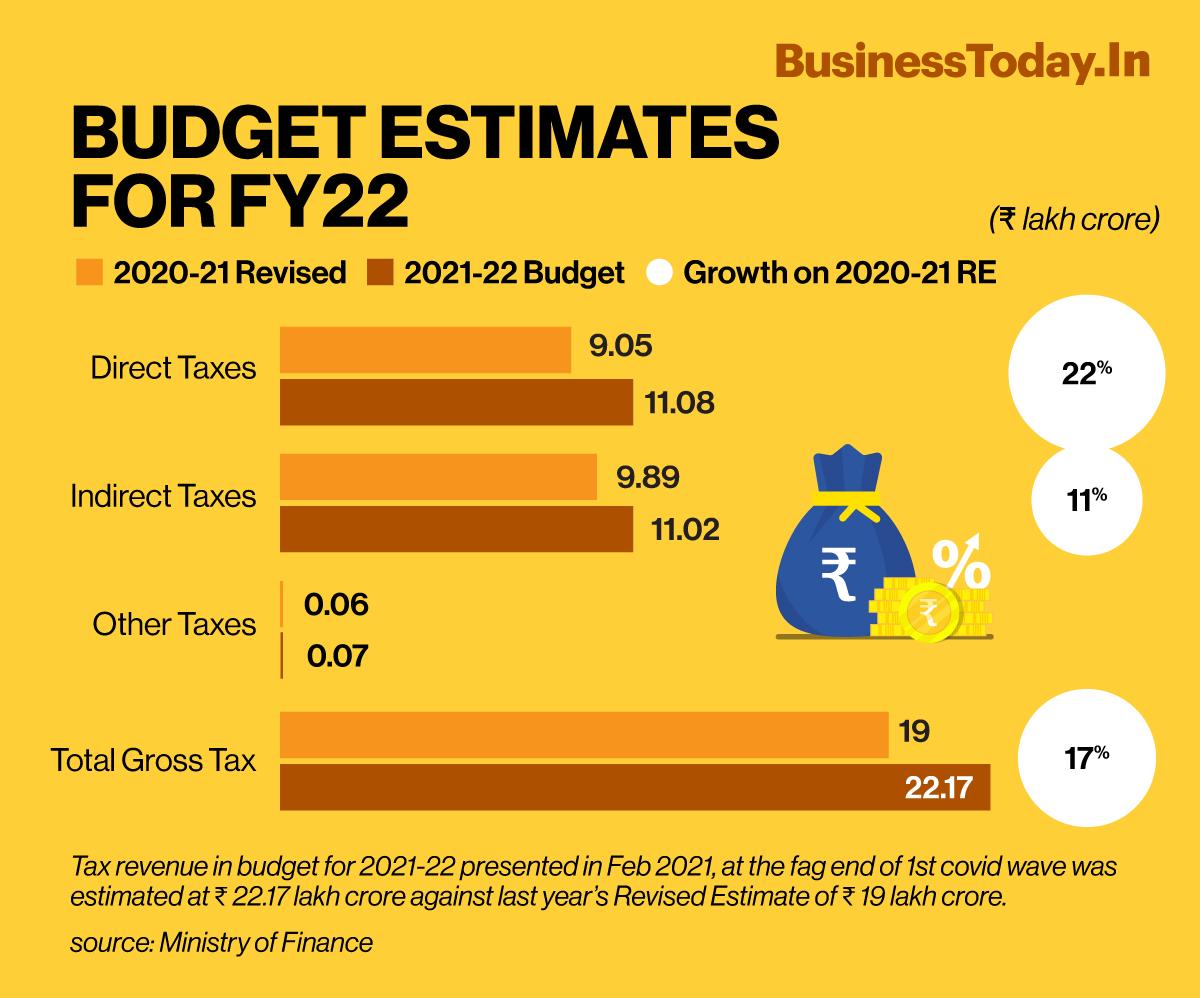

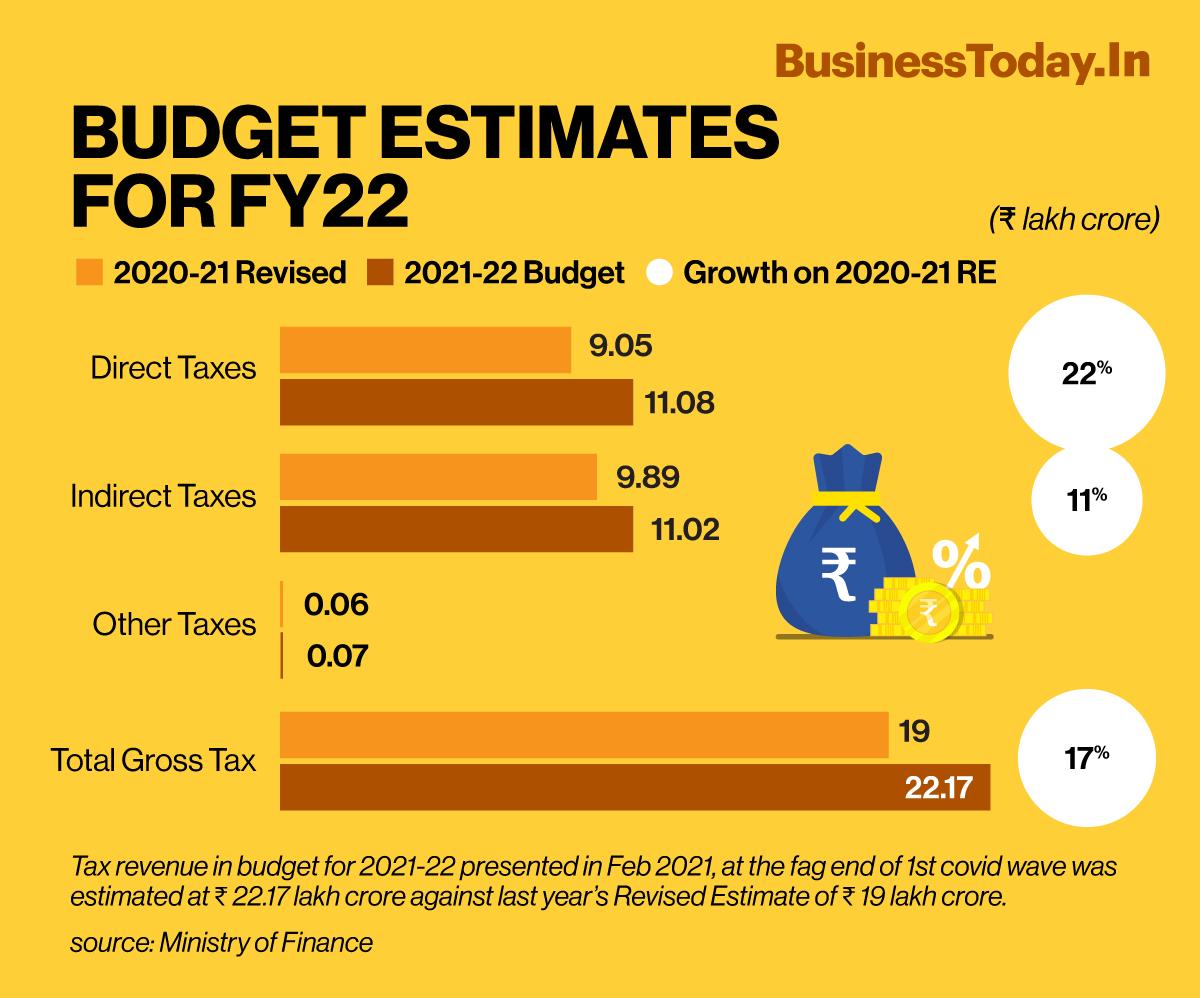

The direct tax collection in the financial year 2021-2022 grew by 49 per cent while the indirect tax collection 30 per cent, Bajaj said.

Bajaj was briefing on the tax revenue highlights of the fiscal year 2021-2022 and informed that government's direct tax collection of Rs 14.10 lakh crore the said fiscal was Rs 3.02 lakh crore more than budget estimate (BE).

Bajaj said the overall tax buoyancy showed a ''healthy, robust figure''. The tax buoyancy came in at about 2, which means the increase in tax collection was around twice as fast as nominal GDP growth rate.

''A lot of technology is being used where GST figures are now being matched with income tax figures and compliances are being ensured. So all these has resulted in better compliance and better revenues both in direct and indirect taxes,'' he told reporters.

Bajaj also added that gross tax collections in FY22 stood at Rs 27.07 lakh crore and customs mop-up grew 41 per cent.

The revenue secretary also added that improved tax revenues show resilience of the economy.

Moreover, indirect taxes like excise duty stood Rs 1.88 lakh crore higher than the budget estimate. Against the budget estimate of Rs 11.02 lakh crore, indirect tax mop-up was Rs 12.90 lakh crore, he said.

Corporate taxes grew 56.1 per cent to Rs 8.58 lakh crore, while personal income tax collection jumped 43 per cent to about Rs 7.49 lakh crore.

During the year, Rs 2.24 lakh crore worth income tax refunds were issued to 2.43 crore entities.

The tax-to-GDP ratio jumped to 11.7 per cent in FY22 from 10.3 per cent in FY21. This was the highest since 1999.

To a question on the Russia-Ukraine war, he said ''the effect on economy is worrisome but would depend on a number of factors like commodity prices and its effect on supply chain''.

The tax authorities have put to good use various tools at their disposal including a repository of information gathered as annual information returns and an effective linkage that has been established between the direct tax and indirect tax wings, government stated.