Das said that the second wave of the pandemic has taken a grievous toll

Das said that the second wave of the pandemic has taken a grievous toll

Das said that the second wave of the pandemic has taken a grievous toll

Das said that the second wave of the pandemic has taken a grievous tollThe RBI will soon start constructing a ‘financial inclusion index’ to measure and improve the extent of access, usage and quality of financial inclusion in the country

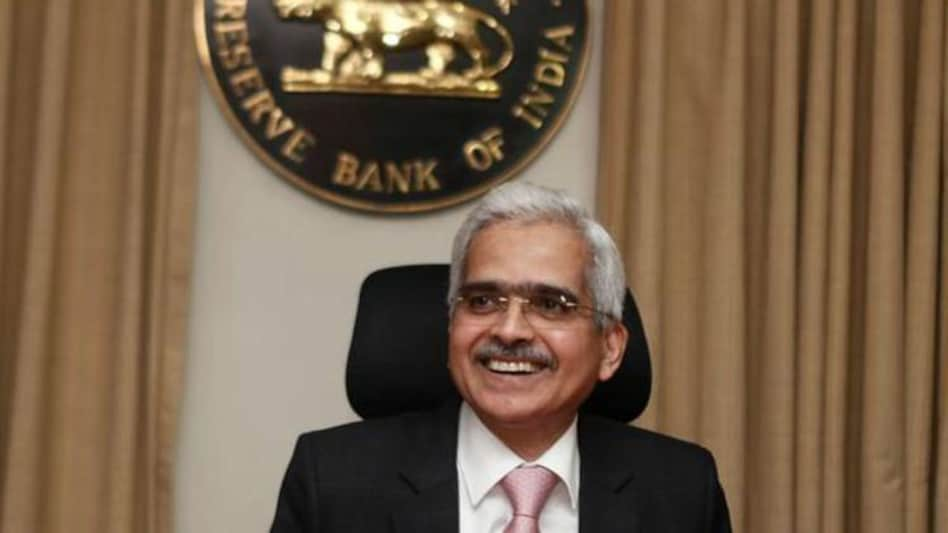

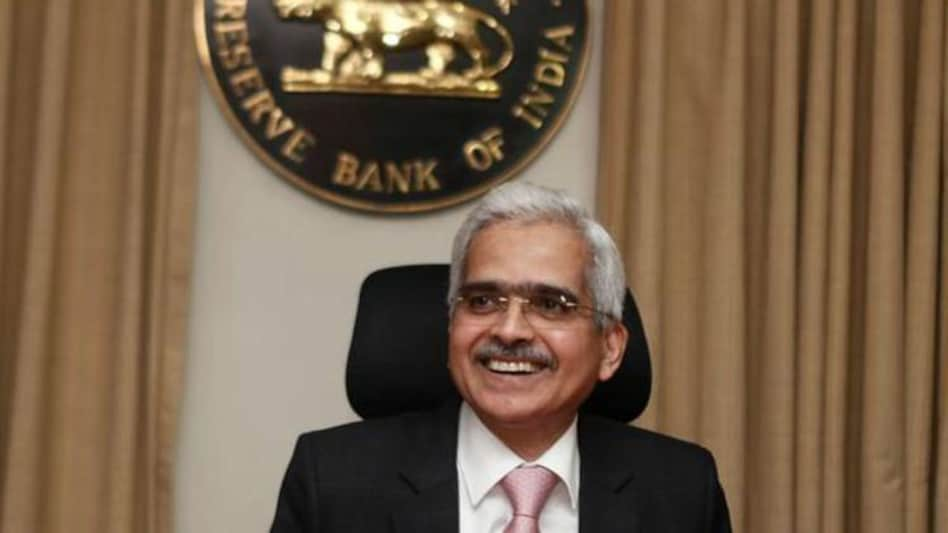

RBI Governor Shaktikanta Das, speaking at an event on Thursday said, ”The index will have parameters across the three dimensions of financial inclusion. Work on the FI Index is underway and the Index will be published shortly by the RBI.”

He said that in India, the second wave of the pandemic has taken a grievous toll both in terms of lives and livelihood. The recovery that had commenced in the second half of 2020-21 was dented by the second wave of the pandemic in April-May 2021. “Our efforts towards financial inclusion, have helped in enabling the government to provide seamless and timely financial support to vulnerable sections through direct benefit transfers (DBT),” he added

Das said the wider adoption of digital payments is reflected by the the number of prepaid payment instruments (PPI) issued as smart cards, internet accounts, online wallets, mobile accounts, mobile wallets and others to access the prepaid amount

The PPI use, according to RBI, increased at a compounded annual growth rate (CAGR) of 53 per cent from 41 crore in May 2017 to 226 crore in May 2021. In May 2021, 91 per cent of PPIs were in the form of wallets and the rest in the form of cards.

Das said, “The digital payment regime has grown since the introduction of fast payment systems, such as Immediate Payment Service (IMPS) and Unified Payment Interface (UPI), which provide immediate credit to beneficiaries and are available round the clock.”

According to RBI data, in June 2021 each day on an average the payment systems in India processed more than 15 crore transactions amounting to nearly Rs 4.5 lakh crore per day.

The UPI platform facilitating payment transactions through smartphones witnessed over 280 crore transactions in June 2021. Das informed that globally, there has been a lot of interest in UPI.

The digital footprint, according to Das, reduced the stress caused by the pandemic. The Aadhaar enabled Payments System (AePS) that facilitates fund transfers/payments and cash withdrawals through micro-ATMs and business correspondents (BCs) using Aadhaar authentication proved critical.

Cash transactions at BC outlets through micro-ATMs witnessed a significant surge with more than 94 crore transactions accounting for Rs 2.25 lakh crore during 2020-21.

Aadhaar, the world’s largest biometric identity, facilitated financial inclusion through innovative digital platforms during the pandemic.

The NACH-Aadhaar Payments Bridge (APB) System and PMJDY together were instrumental in enabling an effective usage of available banking facilities for the ordinary people

During the pandemic, these facilitated cash benefits under Pradhan Mantri Garib Kalyan Yojana were disbursed to 42.59 crore PMJDY account holders. Of these, more than 55 per cent of account holders are women.

RBI says that Rs 5.53 lakh crore was transferred digitally across 319 government schemes spread over 54 ministries during 2020-21 under this mechanism

To promote financial inclusion Reserve Bank has a pilot project going on in association with banks under which, at least one district in each state/UT would be 100 per cent digitally enabled. The project covering 42 districts that started in 2019, according to Das, will facilitate greater access and usage of digital payments by the common man.

As of March 2021, banks have achieved a digital coverage of 95.9 per cent of individuals while the achievement for businesses stood at 89.8 per cent.

In order to promote ‘universal access to financial services’ access to some form of banking outlet has been provided to 99.9 per cent of the targeted villages within a 5 km radius/ hamlets with 500 households in hilly areas.

Also read: Bank credit grows 6.08%; deposits up by 9.76%: RBI

Also read: No reason to revise GDP growth projection downwards: RBI Governor Shaktikanta Das