They lorded over the Indian soft drink market for almost three decades, often setting the rules of the game. Indeed, after PepsiCo entered India in 1989 and Coca-Cola re-entered via a dramatic launch at Agra in 1993, cola had become synonymous with beverages and vice versa. The two US giants applied every tactic in the book to coax, cajole, threaten, acquire or smother local and international rivals. Within a decade, they had cornered nearly all the organised carbonated beverage market between them. Then they battled each other in the bitter cola wars every summer.

But in the past couple of years, the hunters are being hunted in India's Rs60,336 crore soft drink market. Ironically, PepsiCo and Coca-Cola find themselves on the same side of the fence as old and new rivals - Dabur, Parle, Hector Beverages (Paper Boat), ITC, Manpasand Beverages, and a host of others - have managed to push the cola giants into a corner through some innovative healthy beverages, smart positioning and deft moves in the marketplace. Not just that, PepsiCo and Coca-Cola failed to see through the enormous opportunity in milk-based beverages and also couldn't protect their market share in packaged drinking water, even as their attention got diverted to fending off charges of depleting water tables at their plants across the country.

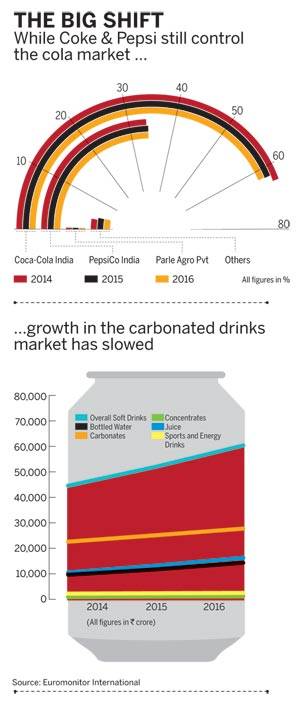

According to Euromonitor, between 2014 and 2016, Coca-Cola India's market share has shrunk from 35.5 to 33.5 per cent while PepsiCo's has gone down from 23.2 to 22.2 per cent. Interestingly, as consumption switched dramatically to healthy beverages, the duo, ill-equipped to tap the new opportunities, have been losing share in a growing market. Their combined share is now down 3 percentage points to 55.7 per cent in a market that has grown from Rs44,624 crore to Rs60,336 crore and continues to grow at a healthy 9.7 per cent per annum. The share of carbonated beverages, commonly referred as colas, was 51 per cent at its peak in 2014 - it's now down to 46 per cent.

This trend is mirrored in the bottled water segment, which has grown 19 per cent in the last five years and at Rs14,270 crore, commands a 24 per cent share of the overall soft drink market. Parle Bisleri is the outright market leader with a 24.6 per cent share while Coca-Cola's Kinley at 17.2 per cent has lost 2 percentage points since 2014. PepsiCo's Aquafina has stagnated at 10 per cent.

True, Coca-Cola and PepsiCo have retained their hold in carbonated beverages with a near 96 per cent share but, unfortunately for them, the segment is lagging overall industry growth. The segment has grown at barely 3.9 per cent between 2011 and 2016. They entered India to tap the potential offered by the abysmally low per capita consumption of soft drinks in the country. And though the per capita consumption has grown from 1.2 litres in 1990 to 13 litres per day today, to their dismay, the bulk of the new growth hasn't come their way. Effectively, the duo has failed to tap a substantial part of the Rs16,000 crore growth, largely in the healthy beverages category, in the past two-three years. And it's getting tougher by the day. The major beneficiaries have been Parle Bisleri and Parle Agro whose combined market share in soft drinks has gone up from 15.8 per cent in 2014 to 17.7 per cent last year. In a highly fragmented market, the rest - including Dabur, UB Group, Dhariwal Industries, Narangs Hospitality, ITC, Bisleri, Parle Agro and Dharampal Satyapal among others - have together risen 1 percentage point in the last three years. Then, there are the smaller players led by Manpasand and Hector Beverages that are also slowly making their presence felt.

Both PepsiCo and Coca-Cola have responded with a range of their own in healthy beverages but the slide in market share is yet to be arrested. While Coca-Cola launched three non-carbonated beverages (Aquarius, a low calorie beverage; Vio, a milk-based beverage and Zico, a coconut water brand), competitor PepsiCo, has promised to bring down the calorie content in two-thirds of its beverage portfolio to 100 or less calories per 12 ounce serving (approx 350 ml) by 2025. It has already launched 7UP with 30 per cent less sugar. While these launches may seem like strategic moves of the two cola giants to strengthen their position in India, the truth is these are desperate tactics to retain and grab market share.

Their delayed entry into the dairy segment is a case in point. The packaged dairy business in India is an even bigger opportunity than all soft drinks - aerated beverages and juices put together - valued at Rs70,924 crore in 2016. Coca-Cola ventured into the category last year with 'Vio' while Pepsi has only recently ventured into this segment with their ready to drink flavored oat milk offering. Experts believe the delay will make it harder for them to start producing blockbuster successes in healthier beverages. The tepid response to Vio only underlines that.

The plight of the Cola giants is evident in their finances. In fiscal 2016, Coca Cola India suffered a 6 per cent decline in net profit while its total income was nearly stagnant at Rs1,833.86 crore. Its operating margin has slipped from 38 per cent to 28 per cent since fiscal 2014. For PepsiCo, the going has been even tougher. Its net loss in FY 2016 widened to Rs554.2 crore from Rs154.83 crore in the previous fiscal while total income declined 15 per cent. Its operating margin has progressively declined from 4.95 per cent in 2013/14 to 1.73 per cent in 2015/16.

WHO MOVED MY COLA?

The growing consumer preference for healthier food and beverages and the excessive use of sugar in their soft drinks has played against the duo. But the two companies' complacency and reluctance to let go off their dependence on carbonated beverages has also proved detrimental.

Only four years ago, PepsiCo had launched a stronger flavoured cola, Atom, in its bid to take on Coca-Cola's Thums Up. It bombed spectacularly, providing the first indication that the market was not ready for another aerated beverage. "It is a case of clinging on to carbonated beverages and not moving on. Both Coke and Pepsi still believe that the low per capita consumption of carbonated beverages in India could work for them, but the consumer has changed," points out former head of marketing of Coca-Cola India, Shripad Nadkarni (currently, co-founder of food start-up, Foodlix) "Colas are not fashionable anymore. They are considered detrimental to health and the cola majors have to understand that," adds Ajimon Francis, Country Head of brand valuation company, Brand Finance.

The cola giants are in a dilemma. Venkatesh Kini, the former head honcho of Coca-Cola India, in an interview with Business Today a fortnight prior to his exit, candidly admitted that there has been three consecutive years of downturn for the company because of a slowdown in rural consumption and steep increase in taxation. The Union Budgets of 2015 and 2016 increased excise duty on aerated beverages by 3.5 per cent and that forced manufacturers to increase prices. To make things worse, Chief Economic Advisor Arvind Subramanian has also recommended a 40 per cent "sin tax" on the category under the Goods and Services Tax (GST). If that happens, PepsiCo and Coca-Cola India will be the worst affected as the consumer shift from colas may get accentuated. "The consumers, their choices today are much more precise and varied. We are therefore transitioning ourselves to being a company that can offer a range of beverages for life. Our innovation pipeline includes products which are non-carbonated and also products that are diets and lighter versions of our carbonated range. Today, about 35-40 per cent of our business is from our non-carbonated portfolio," points out T. Krishnakumar, President, Coca-Cola India and South West Asia, who recently stepped into the shoes of Kini.

The cola giants are clearly in a mood to admit their strategies need immediate overhauling. Vipul Prakash, Senior Vice-President, PepsiCo India, also agrees that dependence on a certain category is a myopic way of looking at a business. "The need to build the portfolio is very clear. Today, the consumer is exposed to more brands, unlike in the past where he only had a carbonated drink for every occasion."

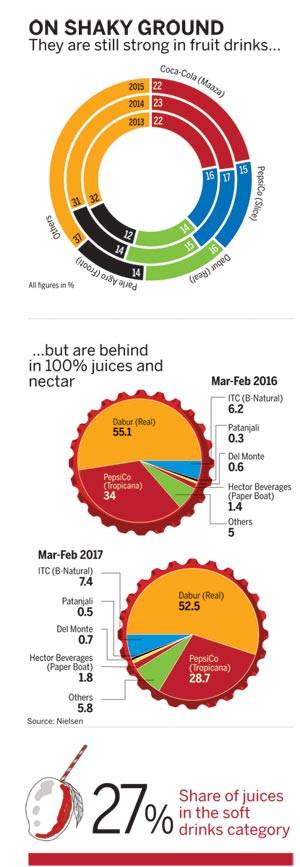

While the company has already taken the first step of reducing sugar content in its products with 7UP, will it be able to do so with Pepsi as successfully? Prakash is unsure. "Obviously, Pepsi will be tougher. It's very difficult for any sweetener to taste like full sugar. So, don't expect it to be the same. Perhaps the classic version can also continue and we could do a Pepsi light, we don't know." Prakash also admits that Pepsi could have done better with its juice brand, Tropicana. Juice as a category has been growing at a robust 16.8 per cent. Despite getting into the market early in 1998, Tropicana has registered a sharp decline in market share - from 33.5 to 28.7 per cent (as per Nielsen) between March 2016 to February 2017 while Dabur is the market leader with a share of 56.3 per cent. "Dabur has done a good job over the last few years in terms of their innovation. We are also doing that but I think we need to step up our game," admits Prakash. While Coca-Cola's mango beverage Maaza is the market leader in the mango juice category, its other juice brand, Minute Maid, has been a slow burner.

The new Coca-Cola India head stresses that his company is taking steps to reduce its dependence on carbonated beverages but says his immediate concern is the possibility of heavy taxes being levied on carbonated beverages, which is the companys bread and butter. "The best way would be to tax based on sugar levels and not carbonation. Carbonated beverages is an affordable indulgence just like a chocolate or biscuit. If the prices are too high, the consumption will go down, consumers may end up getting their beverage needs from somewhere else," points out Kini. In fact, Indra Nooyi, PepsiCo Chairman and CEO, during her recent visit to India met Finance MinisterArun Jaitley to pitch for a lower rate of taxation for beverages under the soon to be implemented GST. Sugar carbonated beverages are likely to fall under the highest 28 per cent category of taxes. Worse, there are murmurs that an additional 15 per cent cess, reserved for those products which the government wants to discourage, may also be slapped on this category of beverages.

HOMEGROWN CHALLENGERS

While the two cola giants are struggling to cover lost ground, homegrown beverage makers are slowly and steadily making headway. There are established companies such as Dabur, ITC, Parle Agro, Bisleri as well as newcomers such as Global Consumer Products, Hector Beverages, Raw Pressery. Then there are regional players including Manpasand Beverages and Caavinkare. Each of these companies has its unique positioning but all of them are focused on fruit-based beverages and not colas. The likes of Parle Agro and Manpasand Beverages are growing their mango beverage business from strength to strength and at the same time foraying into carbonated fruit beverages. It is a category where Parle Agro has the first mover advantage with its brand Appy Fizz. The company has recently launched Frooti Fizz, a carbonated variant of its popular mango drink, which has 11 per cent fresh fruit extracts (as opposed to a Fanta or a Mirinda, which are fruit flavoured beverages). "The beverage category has opened up as consumers are willing to experience new products and are looking for variety," says Nadia Chauhan, Joint Managing Director, Parle Agro.

Similarly, Hamdard recently ventured into the ready-to-drink juice segment, with Rooh Afza Fusion - an extension of its 100 year old brand Rooh Afza - which not only has fresh juice content of 20 per cent, but also retains the flavour of the parent brand. Dabur, on the other hand, not only has the early mover advantage in juices, it has the lead in terms of innovations. From a variety of fruit juices to healthy vegetable juices, Daburs portfolio is much larger than Tropicana or Minute Maid. It has recently launched a mass mango juice brand, Ju.C. to compete with Frooti and Mazaa.

These companies benefit from being a local company. Not only do they understand local tastes better, they are also able to innovate faster. "Domestic companies always have faster decision making. That aids innovation. If I have to take permission from Atlanta or Connecticut or wherever, there will be time-lag. Also, the guidelines in these international companies are very strict. So half of their proposed innovations gets killed there," points out K.K. Chutani, Executive Director, Dabur India. Concurs Mansoor Ali, Chief Sales and Marketing Officer, Hamdard. "When we were working on Rooh Afza Fusion we test marketed several versions. Some which didnt work and we pulled it out at once. Had we been bound by global diktats, I dont think we could have been so flexible," he says.

The other company which has created a niche on the back of innovations is Hector Beverages, a company founded by former Coca Cola India employees. Though it is not yet profitable, by touching the ethnic Indian tastes with juices such as Aam Panna, Thandai, etc, through its Paper Boat brand, Hector has managed to get premium consumer mindspace. "Acquiring speed is a tough one for a large company. The main-stay of the business is their core carbonated beverages. They will always have a small team for innovation, but whenever there is a strain in the business, that segment suffers as the focus is on growing the core business more," says Parvesh Debuka, marketing head of Paper Boat for Hector Beverages. In every FMCG segment in India, homegrown players are not only successful but smarter in their go to market, says Arvind Singhal, Chairman of business consultancy firm Technopak. "It is not a matter of desi versus videshi, but they (Pepsi and Coke) are bound by their own legacy and are not able to think Indian. A Paper Boat will give you the taste that consumers want and can relate to."

THE FRUIT DRINKS REVOLUTION

Both PepsiCo and Coca-Cola have made little headway in the segments that have found favour with consumers and are growing faster-juices and dairy. The packaged juices segment in India - categorised into three sub segments fruit drinks, juices and nectar - has grown at a CAGR of 16.8 per cent over the last 5 years. At Rs16,207 crore in 2016, it accounts for 27 per cent of the soft drink market. While Pepsi has the advantage of a bigger portfolio-Slice in fruit drinks and Tropicana in juices and nectar-it is clearly losing out to local rivals Parle Frooti and Dabur Real respectively. Tropicana has lost 5 percentage points in the last one year at the hands of Dabur, ITC and Hector Beverages. Coca-Cola's fruit drinks Maaza and Minute Maid does give them a significant 33.8 per cent share in juices but it does not have a presence in the other categories. Juices and nectar have higher fruit content and are considered healthier. "Ultimately the market will evolve and consumers will move towards this category," says Deepika Warrier, Vice President, Nutrition category, PepsiCo India.

The pace of innovation in the two companies is visibly slower in this category. When Prime Minister Narendra Modi exhorted beverage companies to mix at least 5 per cent fruit juice in aerated drinks to help distressed farmers around the country in September 2014, Vadodara-based Manpasand Beverages was ready with such a drink, Fruits Up, within a week. Mixing fruit with aerated beverages would create a healthy demand for fruits across the country thus benefiting farmers while, at the same time, it will at least partly take care of the high sugar content in these drinks. Though most beverage companies claim it was already part of their gameplan much before the PM's speech, his appeal did speed up the process. Indian companies seem to have a head start in this area.

Yet, it may not be all smooth sailing for the homegrown firms. At least 600 odd-beverages are launched every summer in India but 90 per cent of them do not live to see another season. With their deep pockets and distribution network, Coca-Cola and Pepsi may still capture the market with a me-too beverage. Smaller players face the challenge of scaling up quickly. "To sustain distribution for a full year, one needs deep pockets for a broader portfolio of products," points out Abheek Singhi, Partner (Head, Consumer Practice), Boston Consulting Group. Agrees Prakash of PepsiCo. "They understand local taste better than us and are free spirited. Their biggest limitation is scaling up, that's why you will not find these people being able to go outside their state." Abhishek Singh, Director at Manpasand, believes most beverage businesses lack long-term focus. "One needs to have a solid hold on manufacturing," he says.

PROBLEMS GALORE

Increasing competition is not the only challenge the two cola giants are grappling with. They also find themselves at the centre of a backlash over depleting water table across the country. In March, two major trade bodies in Tamil Nadu - the Federation of Tamil Nadu Traders Associations (FTNTA) and the Tamil Nadu Traders Associations Forum (TNTAF) - banned the sale of Coca-Cola and Pepsi beverages across the state blaming the companies for extracting too much water from rivers that has increased problems for farmers in the state. The issue is still unresolved. "We pay the price for being a large, visible consumer brand," says Krishnakumar of Coca-Cola India. "In Tamil Nadu, we had nothing to do with what transpired in the beginning of the year. Yet we were targeted. We listened, engaged and clarified."

A week later, a similar call for boycott was given by a trader in the neighbouring state of Kerala but it has not had much impact. PepsiCo however, has faced relentless resistance from locals in Kerala for drawing water from the Kanjikode area for its bottling plant in Palakkad. The plant operates at way less than optimum capacity today after the state government put a temporary restriction on industrial water consumption in the state. Coca Cola also had a factory in the vicinity but it had to shut it down back in 2004 after facing a similar resistance. There are also protests against the Atlanta based firm in Hoshangabad in Madhya Pradesh where it is setting up a Rs750 crore greenfield bottling unit. It would be Coca-Cola's biggest in India and draw water from the Narmada. A group of local activists have started an agitation, claiming it would cause pollution and water scarcity in the region and are planning to file a petition in the Jabalpur High Court. The two companies have steadfastly refuted allegations and claim they replenish the water table more than they exhaust. "Through our rainwater replenishment initiatives, we return 148 per cent water to the ground than our usage, yet we are targeted," says Krishnakumar. The ire, however, is directed only at the two companies, which means the field is open for the homegrown companies to invest and grow.

With challenges multiplying, will PepsiCo and The Coca-Cola Company be able to regain their erstwhile glory? They have to change their strategy in order to succeed. For now, the odds are against them.~

@sumantbanerji; @ajitashashidhar