Sachin Gupta is 36 and stays in New Delhi with his wife Tripti (36), two daughters, eight-year-old Aarna and one-and-a-half-year-old Arika, parents and grandmother. He runs his family business, a stock broking services firm, where he is the chief operating officer. The couple's combined monthly income amounts to Rs 2.5 lakh. And just like other young parents, the Guptas have not given much thought to financial planning for the future until now. The challenge here is to meet all current requirements and build a safety net while preparing for long-term goals such as the daughters' education and marriage, and the couple's retirement.

The positive thing about the Guptas is that they have no big financial liabilities such as a home loan, a car loan or even a personal loan. But there are some major drawbacks as well. To start with, the family has no life insurance cover, and the medical insurance only includes a family floater of Rs 20 lakh. Moreover, their investments are not aligned with specific goals - both short-term and long-term.

Current Scenario

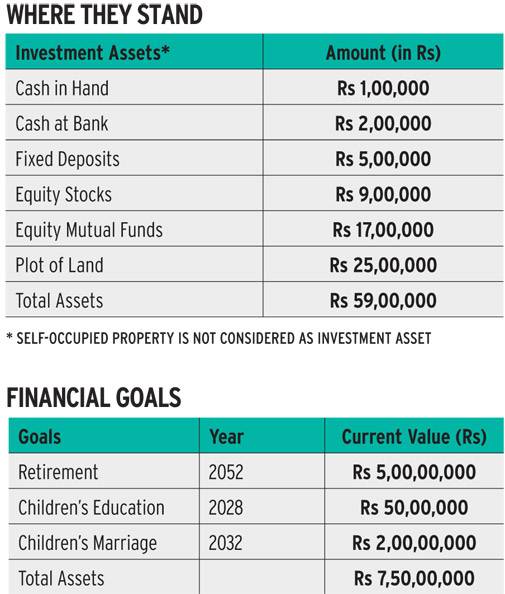

Assets and liabilities: Sachin has invested about Rs 17 lakh in equity mutual funds and another Rs 9 lakh in equity shares. He is also putting in Rs 24,000 a month in an equity-linked savings scheme (ELSS) fund for tax saving. His current debt portfolio includes cash in hand and cash at bank, totalling to Rs 3 lakh.

Insurance portfolio: The family is not covered under any life insurance policy. They have a medical insurance from ICICI Lombard - a family floater policy of Rs 20 lakh - for which they pay a premium of Rs 28,000 per annum.

Cash flow - income versus expenses: For Sachin, the take-home salary per month before tax is about Rs 1.5 lakh while Tripti earns Rs 1 lakh. They own the house where they stay and do not wish to upgrade their home. Their total monthly outflow is Rs 1.5 lakh, and the total annual premium for all the policies amounts to Rs 28,000. The family is expected to generate a surplus of approximately Rs 12 lakh in the current financial year, which should grow in the future as we have assumed a 10 per cent hike in Sachin's earnings, year on year.

Risk tolerance and asset allocation: As of now, the biggest chunk of asset allocation is into equity, with very little debt investment (see Table: Where They Stand). As equity investments outperform other asset classes in the long run, part of his investments can be put into equity assets to grow the investment corpus. But the major long-term goals are still years away, and Sachin has time on his side to create the corpus required. Therefore, some low-risk investments are very much on the cards, and it is important that the family should channelise a portion of the investible surpluses into debt instruments to meet their near-term goals.

Feasibility Study and Goal Fixing

A feasibility study was done by taking into account the current assets and investments of the family along with the year-on-year surplus (yearly income over yearly expenses minus insurance) till their respective retirements. After plugging in the requirements as and when they will turn up till the spouses are 80 years old, it is seen that the family will be able to achieve all their goals quite smoothly. The study has been done assuming a regular increment in their respective incomes till their retirement and also assuming that family expenses will drop after retirement (by about 40 per cent as the daughters will become independent and get married; also, in most cases, living and lifestyle expenses come down post retirement). Medical insurance premiums, too, have been taken into consideration till the couple turns 80.

Key goals: Sachin has a few medium- and long-term goals, including his daughters' education till post-graduation, their weddings and building a substantial retirement corpus without any liability (see Table: Financial Goals). He wishes to retire at the age of 70, and we have assumed that Tripti will be working till she is 60 years old (see Table: Financial Goals).

the Road Map

Insurance: The family's insurance requirement has been analysed based on the expense replacement method that includes all future expenses, future goals, additional sources of income, existing life insurance cover and current assets and liabilities till they are 80. It is recommended that Sachin should buy a term life cover of Rs 2 crore. Its premium will be in the ballpark of Rs 20,000 annually.

Also, each member of the family should have an individual health insurance cover, with Rs 5 lakh sum insured for each. They should also get a super top-up policy of Rs 10 lakhs with Rs 5 lakh deductible for each family member. It may be a good idea to buy both health insurance policies from the same insurer for hassle-free claim processing and reimbursement. The combined premium for four will be around Rs 30,000 per annum (basic+super top-up).

Investment: To meet the liquidity needs and provide for unforeseen contingencies, Sachin should keep aside a sum of Rs 1.5 lakh in the bank (out of Rs 3 lakh) and invest Rs 1.5 lakh in liquid mutual funds. This amount can cover the average monthly cash outflow and will come in handy in case of an emergency.

Fund allocations: An investment road map for the family has been created by taking into account current assets and investments as well as earlier investments (see Table: Plan of Action). The monthly investment in ELSS should be stopped, and in its place, Sachin should invest a lump sum of Rs 1.5 lakh every year. The approximate annual surplus for the current financial year will be Rs 12 lakh, which means a monthly amount of Rs 1,00,000, out of which Rs 60,000 can be put into equity mutual funds through a systematic investment plan or SIP to address the goals coming up in the future. The corpus created will take care of retirement as well as children's education and their marriage.

The equity share portfolio can be pruned to Rs 5 lakh from Rs 9 lakh. From the equity share sale proceeds, Rs 1 lakh can be invested into liquid funds for additional liquidity/contingency needs and the remaining Rs 3 lakh should be invested in equity mutual funds. The balance Rs 40,000 per month, which is available as surplus, can be invested in debt-oriented mutual fund schemes. Equity mutual funds are expected to give 12-15 per cent return in the long term while debt mutual funds are expected to offer 7-9 per cent on a short-to-medium term period.

The annual surpluses will increase as income growth is assumed to be higher than the inflation rate. Therefore, surplus accumulations can fund all other goals as and when they come up, provided the couple judiciously invests the monthly surplus in a suitable investment vehicle, after consulting an advisor (see Table: Fund Allocations). Cost of land is not included in the calculation due to sharp reduction in price over the past couple of years.

Tax planning: In a bid to avail tax benefits under section 80C, Sachin should invest a lump sum in ELSS mutual funds while Tripti can start a public provident fund (PPF) scheme with Rs 1.5 lakh. In fact, the PPF investment will provide more debt exposure to asset allocations. Premiums paid on healthcare policies will also help them reap up to Rs 25,000 a year in tax benefits under section 80D.

This plan has been drawn up based on the information provided by the Guptas. As per our assessment, they will be able to meet all their financial goals. The important thing is to channelise the available surpluses into investments in a disciplined manner. Also, they should review the plan and rebalance their portfolio periodically, preferably every year, to achieve favourable outcomes.

As told to Priyadarshini Maji

If you need help on how to manage your money, write to us at moneytoday@intoday.com for expert advice.