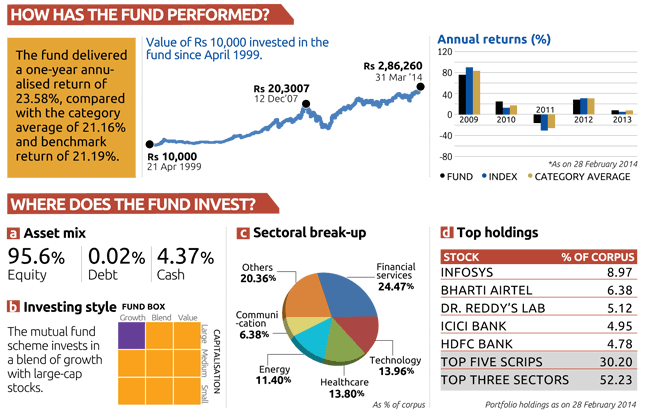

Franklin India Taxshield has a three-year annualised return of 9.39 per cent, compared with the benchmark's 4.62 per cent

FUND FACTS

INCEPTION: April 1999

CATEGORY: Equity Tax Planning

TYPE: Open-ended

AUM: Rs 996.55 crore

BENCHMARK INDEX: CNX 500

WHAT IT COSTS

NAV: Rs 277.67 (G), Rs 30.74 (D)

MIN INVESTMENT: Rs 500

MIN SIP AMOUNT: Rs 500

EXPENSE RATIO: 2.47 per cent

EXIT LOAD: NA

A large-cap oriented fund with a bottom-up investment strategy, this fund always stays fully-invested. The most distinctive feature of the fund's performance history is its ability to do better than its peers when markets crash. It fell only 15.19 per cent as compared to the category average of 23.82 per cent in 2011.But in the next year it slightly lagged behind its peers in terms of performance. The fund's long term returns are attractive, with a trailing fiveyear return of 21.48 per cent and it is ahead of its benchmark. Invest in this fund because it provides safety with reasonable returns, which is exactly what most investors in tax-saving funds need.

MEET THE FUND MANAGER

Anand Radhakrishnan has over 18 years of experience. His prior assignments includes PMS fund manager in Franklin Templeton AMC, Fund manager in Sundaram Asset Management Company and Deputy Manager, Portfolio Manager of Asian Convertible and Income Fund - SBI Funds Management Ltd.

(Data and analysis of the fund have been sourced from Value Research)