Overall Winner (Mid-sized bank)

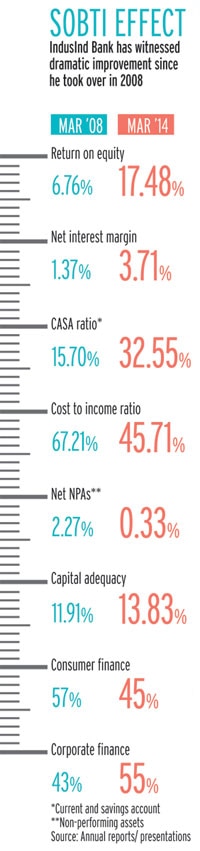

Ten new banks were set up in the mid-1990s, after the banking sector was liberalised and new entrants permitted. Only five of them have survived. Of these, three were backed by established institutions: ICICI, HDFC and UTI (which set up Axis Bank). The sole exception is the Hindujas-promoted IndusInd - it has not only survived, but thrived. In the last six years in particular, it has improved on every banking parameter.

At that time, the bank had practically no retail products barring vehicle financing, which was close to 60 per cent of its total loan portfolio. (The rest were corporate loans.) "We have grown the vehicle finance book," says Sobti. "It's a profitable core business. We have domain knowledge and we dominate the domain." But he and his team have de-risked the loan portfolio as well, adding several new retail products over the years - loans against property, loans against shares, gold loans, personal loans and business loans. In April 2011, IndusInd Bank also bought Deutsche Bank's credit card business.

Currently, vehicle loans are down to 21 per cent of the total loan portfolio - 16 per cent on commercial vehicles, and five per cent car loans. In all, retail loans, much more diversified than before, comprise 45 per cent of the portfolio, corporate loans making up the rest. The latter is carefully diversified between large, mid-sized and small industries at 29 per cent, 17 per cent and 11 per cent, respectively. Sectors such as power, food and beverages, gems and jewellery and real estate have three per cent exposure each. "We do not want to be a niche bank as those are prone to cyclical risk," says Sobti, "In this market, it pays to be a universal bank. We will work on both sides of the balance sheet - assets and liabilities. We will work with all kinds of clients, products and services." He maintains that in the next 12 to 18 months, corporate and retail loans will have a 50:50 ratio. "This will also have a positive impact on interest margins," he adds.

IndusInd Bank is, no doubt, prospering, but competition is strong. Banks which began well after it did, such as Yes Bank and Kotak Mahindra Bank, are catching up with their retail offerings. After its recent merger with ING Vysya Bank , Kotak Bank, which began operations only in the mid-2000s, has a branch network of over 1,200 against IndusInd's close to 700 branches. Two more banks will be set up soon by IDFC Ltd and Bandhan Financial Services Ltd. Sobti maintains he is unfazed, but he too is busy scaling up the distribution network. Just 15 months ago, IndusInd had only one branch in Patna; now it has nine and intends to add two more. Until a few years ago, it had eight branches in Gurgaon; now it has 22 and plans to raise the number to 28.

"How do you draw customers if you are a mid-sized bank, low profile and not a big brand," asks Sobti. His actions at IndusInd Bank have answered the question - use technology to create differentiated banking products. "I call it responsive innovation," he says. Thus IndusInd is one of the few banks where customers can choose the denomination of notes they get while withdrawing money at an ATM. It has introduced 'cash on mobile', which enables people to withdraw the money transferred to them without a debit card, by simply keying in a PIN number received over their mobiles. It has a 'quick redeem' scheme which allows credit card users to instantly redeem their points after making a purchase. It was the first to introduce video banking by which a customer can view bank officials while speaking to them. The effort is paying off - IndusInd Bank now has five million customers, getting 50,000 to 55,000 new ones a month against 4,000 to 5,000 five years ago. "But it is not just about getting ideas," Sobti adds. "It is also about translating ideas into reality, which has to be an orchestrated effort."

Analysts agree the future is bright for banks like IndusInd. "Public sector banks, which dominate the sector, are starving for lack of capital, with growing NPAs," says Sachin Shah, fund manager at Emkay Global Financial Services Ltd. "This offers an opportunity to private players to increase their market share."