Ranita Gupta tried to log on to the new income tax portal to file her income tax return (ITR). She could not do so as she did not receive the OTP on her registered mobile number. Akhilesh Singh did manage to sign in and file the ITR. But the acknowledgment disappeared and he could not download it later. “The new website is pathetic. It will test your patience to the limit. I filed ITR-1, but it took me days,” he says.

Some people were able to file ITR but could not e-verify. “The site did not accept the OTP sent on the registered number. It redirected me to an infinite loop of I-T and bank portals,” says Punit Bhargava.

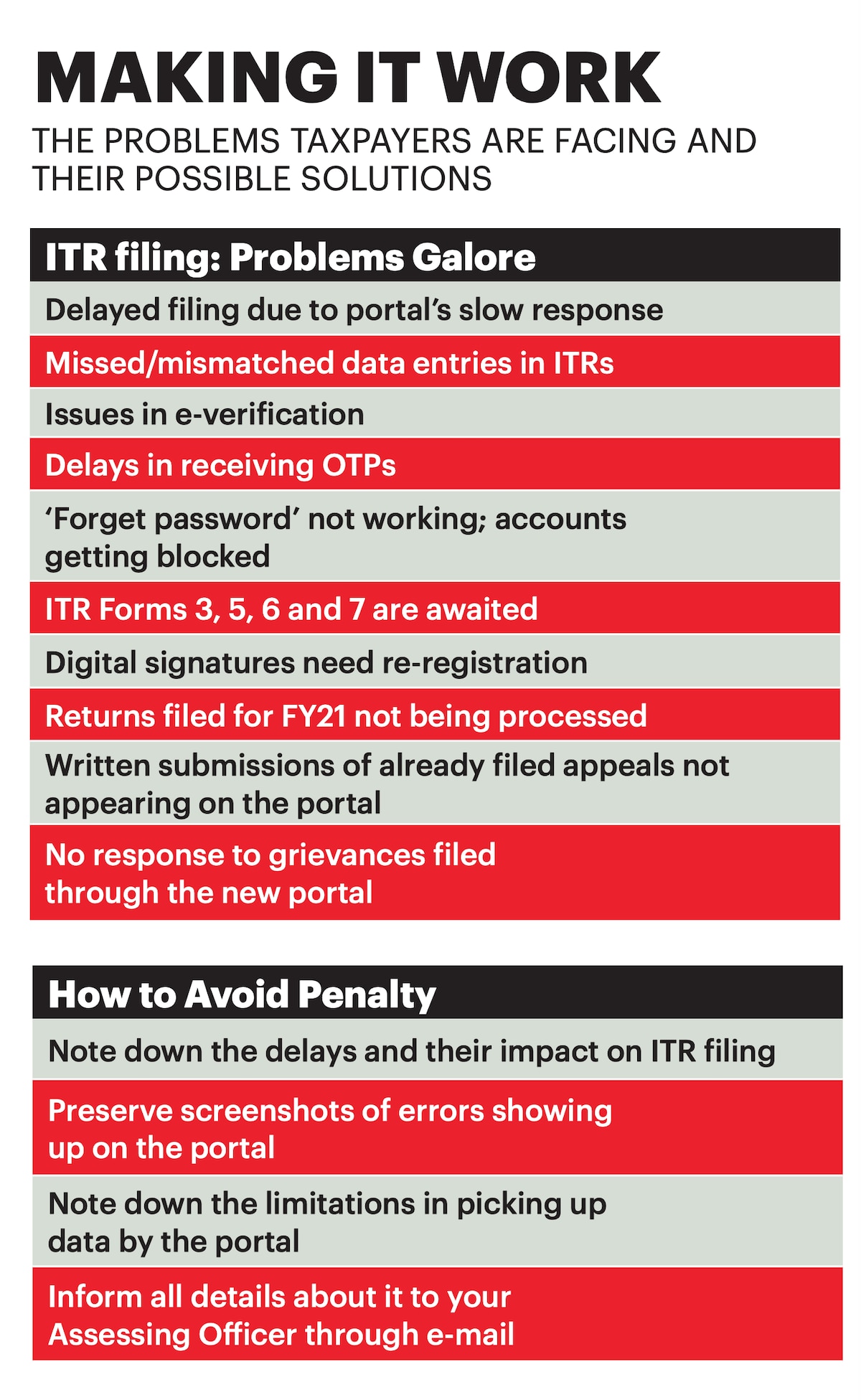

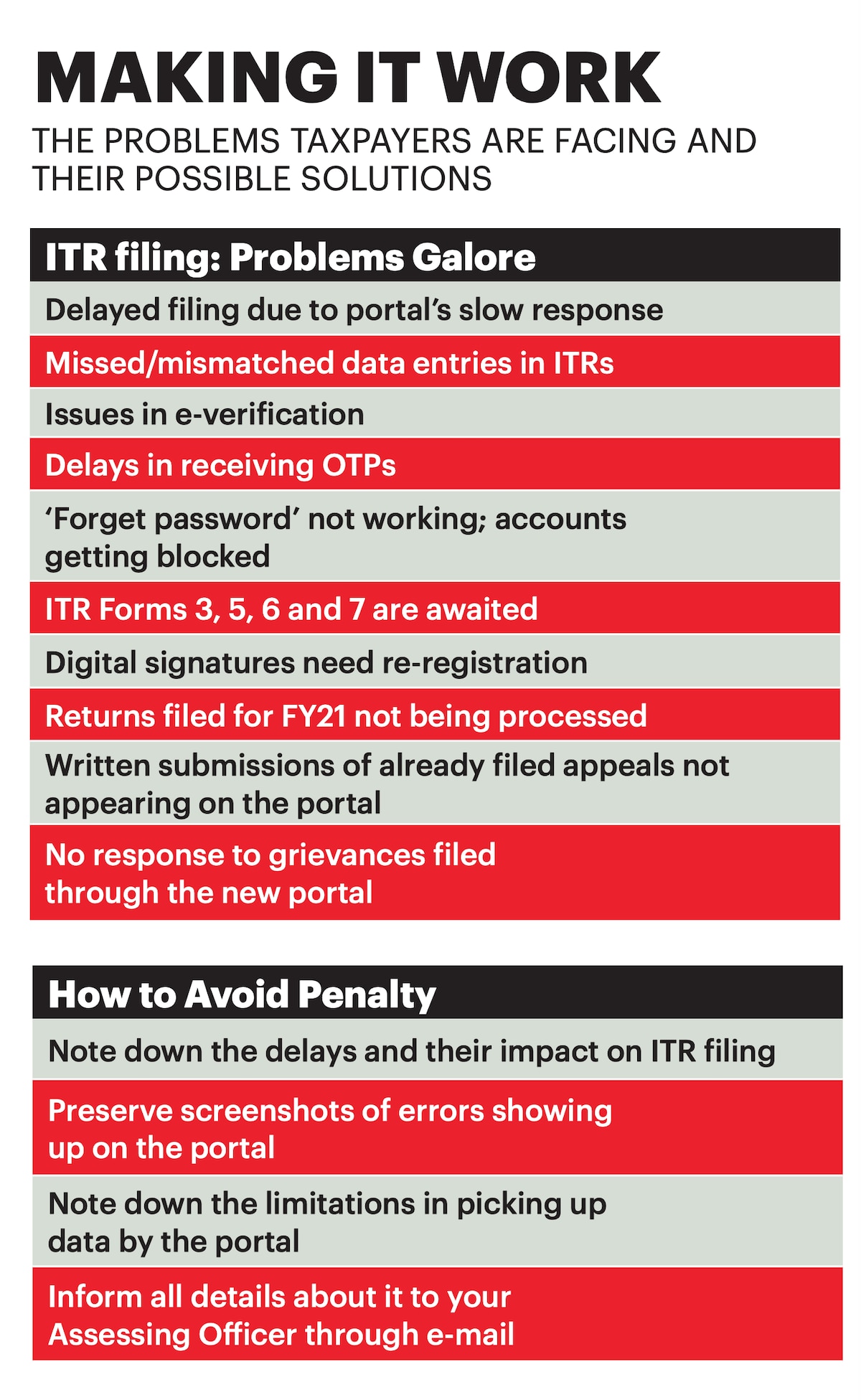

That is not all. The portal does not auto-generate tax deducted at source (TDS) values. In case it does, there are calculation errors. The pre-filled TDS information in ITR forms and what appears on Form 26-AS is not matching. At times, the ‘forget password’ function is not working. If you enter the wrong password three times, the account gets locked. In some cases, legal heirs of the deceased have been unable to get themselves registered for filing ITR, submissions or appeal.

This is a small list of issues taxpayers are facing while filing their ITRs on the new portal. The last date for filing is September 31, but there are problems galore, not just for taxpayers but also seasoned chartered accountants (CAs). “The utility of all income tax return forms is not available as of now. Only ITR - 1, 2 and 4 are available; ITR – 3, 5, 6 and 7 are still awaited,” says Anurag Jain, Partner, ByTheBook Consulting LLP. Forms 10-A and 10-B, for registration of charitable institutions, are also not available on the portal.

Even CAs are wondering why there was a need to build a new portal when the old one was working fine. “There was no need to launch a new website at a time when people are struggling to work from home (WFH). The old website was working fine. Just a few edits would have sufficed. Evaluating the new website and guiding the team in the WFH situation is a challenge for all CAs,” says Mohnish Wadhwa, Partner, Wadhwa & Shah, a chartered accountancy firm.

Simple issues related to digital signature, PAN and Aadhaar have become a pain for taxpayers. “Digital signatures were registered on the old website. The taxpayer has to re-register the signatures on the new portal, which shows an error,” says Wadhwa.

In another issue, the new income tax portal is trying to match PAN data with Aadhaar data. “In many cases, only the birth year is appearing in place of birth date in Aadhaar data. Aadhaar carries the residential address in a majority of cases whereas address on PAN could be business/office premises,” says Wadhwa.

Private software and third-party apps are not working smoothly either. “Taxpayers have been facing issues such as slow page responsiveness and load time errors. Many taxpayers have reached out to us. Even tax experts are reporting issues with certain compliances,” says Archit Gupta, Founder and CEO, ClearTax.

Refunds, Queries Pending

Jain says there are some FY20 returns which are not yet processed. Hence, there is a delay in refunds. “Taxpayers are not able to file tax returns under Section 148 of the Income Tax Act for earlier years as download of utility is happening erratically and attachment of digital signature is not taking place consistently even though the return is required to be filed within 30 days of the receipt of notice,” he says. Section 148 grants an assessing officer (AO) the power to assess or re-assess any taxable income that may have gone under the radar.

Apart from this, there is no option to send a request for obtaining intimation under Section 143(1) where tax demands have been raised, he adds. The facility for filing of online rectification application is also not available on the portal yet.

The written submissions of already filed appeals which have been partly heard are also not reflecting on the portal. “Old rectification applications u/s 154 which are pending are not on the portal. Taxpayers are unable to access old records. There are anomalies in the data.

All this is making it hard for assessees to reply to notices and manage compliances for which due dates are fast approaching,” says Wadhwa.

No Convincing Roadmap

Over 700 emails dealing with 2,000 issues, including 90 unique issues/problems, have been received from various stakeholders, Minister of State for Finance Pankaj Chaudhary informed the Rajya Sabha in July. The grievances filed through the new website have remained unanswered. “The FM says the issues will be resolved soon, but how? What is the roadmap? What about the pile-up which has happened so far?” says Wadhwa.

The solutions offered so far are acting as an additional burden. For example, CAs have to submit Form 15CB online for allowing clients to make foreign remittances. “The government said that since the website is not working, we can fill an offline Form 15CB and submit to bankers for the purpose of convenience, but with a condition that when the website is in place, the CA will file all historically issued physical Form 15CBs online also. Where is the ease of doing business here?” asks Wadhwa.

What You Should Do

“Any new system takes time to stabilise and there are teething issues which get resolved over time. Due to the complexity of taxation and fine-tuning of user experiences, some bugs and issues may exist. Our experience tells us that it may take longer for things to stabilise,” says Gupta of ClearTax.

There could be further extension of deadlines. “In case the due date for ITR filing is extended, the government should ensure that no interest is charged on outstanding tax liability. In FY20, on account of extension of the deadline, the government had provided relief under Section 234A (i.e. interest for delay in filing of tax return) to taxpayers whose self-assessment tax was less than Rs1 lakh. This year, due to glitches in the I-T portal, the government should provide relief to all taxpayers,” says Jain.

What the government may or may not do is uncertain. What you should do is clear — safeguard yourself from penalisation due to glitches in the portal.

Sujit Bangar, Founder, Taxbuddy.com, has some suggestions: Mostly, the government extends dates or issues specific notifications for interest and penalty. To shield oneself from such consequences, we may take proactive steps such as noting down the delays due to the portal and its impact on ITR filing, preserving the screenshots of such issues and informing the AO through an e-mail. Also, note down the limitations in picking up data by the portal and inform the AO of the same to guard against initiation of penal proceedings.”

We can only wait for more clarity and further deadline extensions. “Bring back the old website” is the clear voice coming in from taxpayers and charted accountants alike.

(The writer is a freelancer based in New Delhi)