The price range for the issue is Rs 1,865–Rs 1,960 per share, setting the valuation at Rs 1.51 lakh crore–Rs 1.59 lakh crore for India’s second-largest passenger carmaker.

The price range for the issue is Rs 1,865–Rs 1,960 per share, setting the valuation at Rs 1.51 lakh crore–Rs 1.59 lakh crore for India’s second-largest passenger carmaker. The price range for the issue is Rs 1,865–Rs 1,960 per share, setting the valuation at Rs 1.51 lakh crore–Rs 1.59 lakh crore for India’s second-largest passenger carmaker.

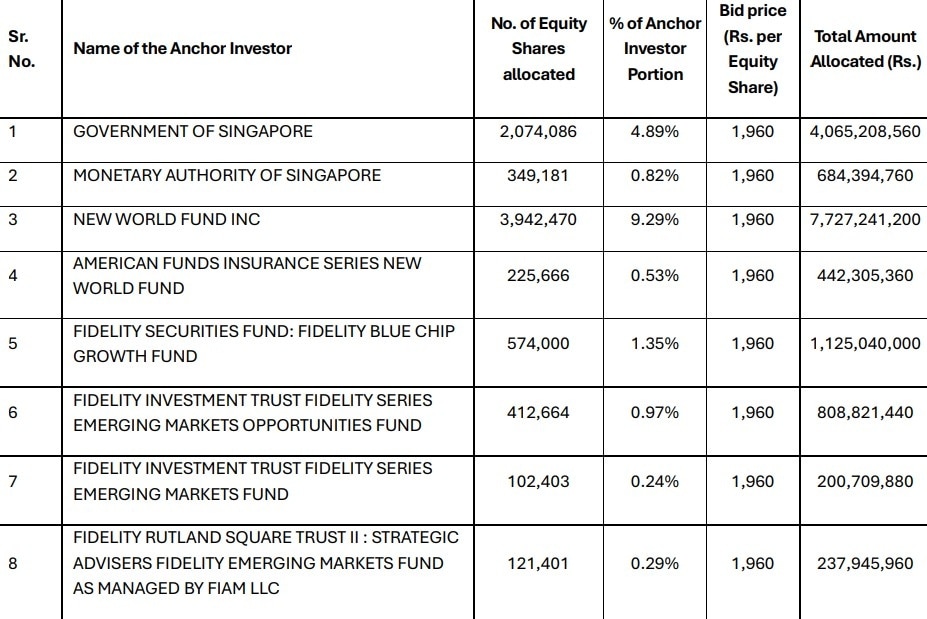

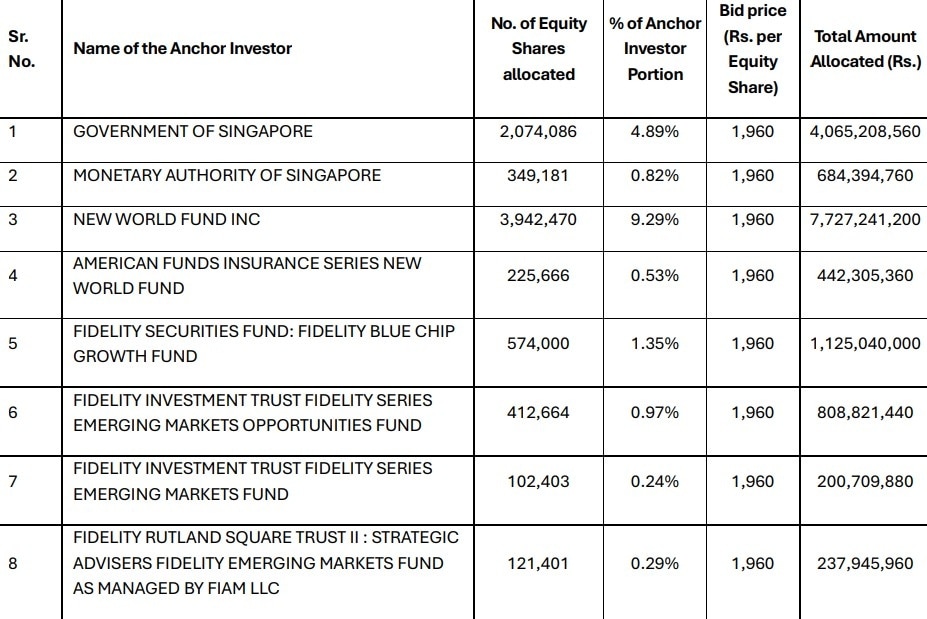

The price range for the issue is Rs 1,865–Rs 1,960 per share, setting the valuation at Rs 1.51 lakh crore–Rs 1.59 lakh crore for India’s second-largest passenger carmaker.Hyundai Motor India IPO is due to open on October 15. The Indian arm of Hyundai Motor Company (HMC) successfully raised Rs 8,315 crore from anchor investors by allocating 42.2 million shares to 225 funds at a price of Rs 1,960 each, which is at the higher end of the price range. Noteworthy investors who received shares include GIC (the Singapore government’s sovereign wealth fund), New World Fund, and Fidelity. Additionally, 21 domestic mutual funds, such as ICICI Prudential MF, SBI MF, and HDFC MF, were allotted shares through a total of 83 schemes.

"The IPO Committee of the Company, at meeting held on October 14, 2024, in consultation with Kotak Mahindra Capital Company Limited, Citigroup Global Markets India Private Limited, HSBC Securities and Capital Markets (India) Private Limited, J.P. Morgan India Private Limited, and Morgan Stanley India Company Private Limited ("Book Running Lead Managers”), has finalized allocation of 42,424,890 Equity Shares, to Anchor Investors at Anchor Investor allocation price of Rs. 1,960 per Equity Share (including share premium of Rs. 1,950 per Equity Share)," the company said in an exchange filing.

The IPO of HMIL is the largest ever in the country, but its anchor issue size is smaller than that of digital payments firm One 97 Communications (Paytm), which had a Rs 18,300-crore IPO in 2021. Paytm, being a loss-making company, had to allocate a higher percentage of shares to qualified institutional buyers (QIBs), resulting in a larger anchor allotment.

Anchor allotment, which is for prominent investors, is conducted a day before the IPO to build confidence and provide guidance for other investors.

HMIL's IPO, which is open to all categories of investors from Tuesday to Thursday, is considered a critical evaluation of the depth and appeal of the domestic equity markets.

The price range for the issue is Rs 1,865–Rs 1,960 per share, setting the valuation at Rs 1.51 lakh crore–Rs 1.59 lakh crore for India’s second-largest passenger carmaker.

Hyundai India's IPO

In its initial public offering (IPO), HMIL is aiming for a valuation that is 26.3 times its FY24 earnings. This valuation is approximately 10% lower than that of the market leader, Maruti Suzuki India (MSIL).

The parent company will receive all IPO funds, excluding issue expenses, due to it being an offer-for-sale. The primary objective is to successfully complete the offer-for-sale by the promoter and reap the benefits of being listed on the stock exchanges.

The company has allocated 50% of the net public issue size (IPO less the employees portion) for qualified institutional buyers, 15% for non-institutional investors, and the remaining 35% for retail investors.

Investors have the option to bid for a minimum of seven equity shares in the IPO and in multiples of seven shares thereafter. Therefore, retail investors can potentially invest between Rs 13,720 (7 shares x Rs 1,960) and Rs 1,92,080 (98 shares x Rs 1,960) in the IPO, as their investment cannot exceed the limit of Rs 2 lakh.

Hyundai India's market

Ranked as the second-largest auto OEM in India's passenger vehicles segment, Hyundai Motor India holds a market share of nearly 15 percent, following Maruti Suzuki India. Despite seeing a decrease from 17.6 percent in FY20, Hyundai faces stiff competition from domestic rivals like Maruti Suzuki India, Tata Motors, and Mahindra & Mahindra.

Outside of Korea, Hyundai Motor India boasts the second-largest manufacturing and supply chain ecosystem within the Hyundai Motor Group. The company offers a diverse portfolio of 13 models spanning various passenger vehicle segments, including sedans, hatchbacks, SUVs, and EVs. In addition to vehicles, Hyundai also produces transmissions and engine parts.

The company has announced a commitment of Rs 20,000 crore for electric vehicle (EV) development in India over the next eight years. The South Korea-based brand plans to utilise India as a key manufacturing hub for producing mainstream EVs.