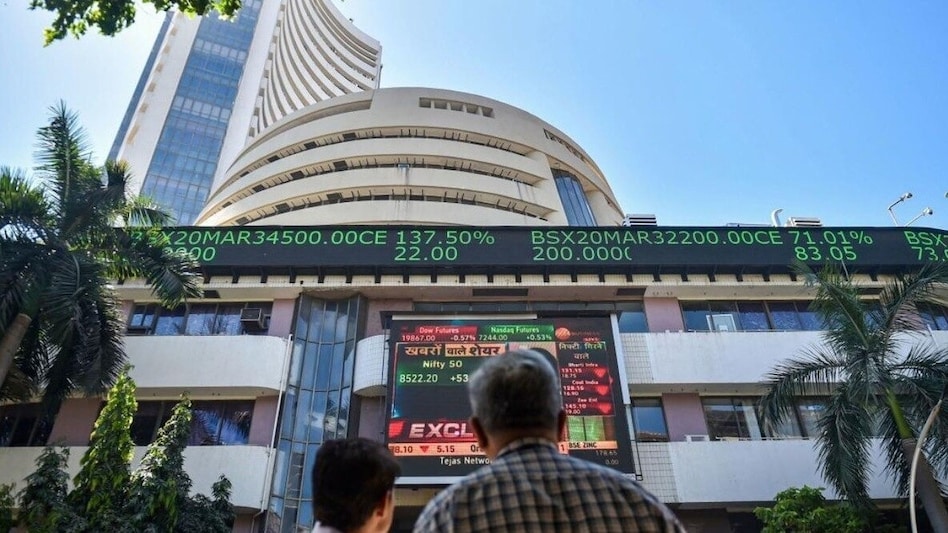

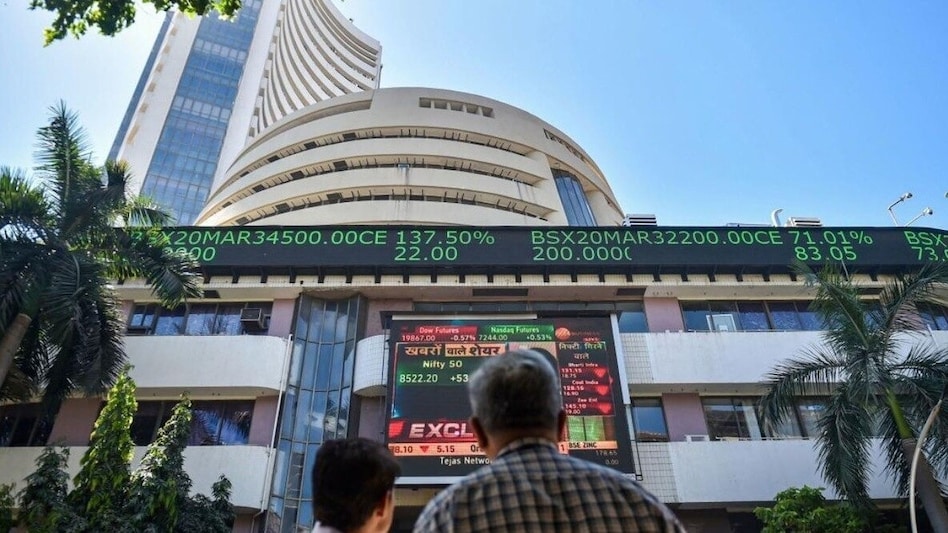

H1 CY25 to be affected by global uncertainties, says ABSL MF

H1 CY25 to be affected by global uncertainties, says ABSL MF

H1 CY25 to be affected by global uncertainties, says ABSL MF

H1 CY25 to be affected by global uncertainties, says ABSL MFFirst half of the CY25 will be affected by the global trade uncertainties mainly due to Trump’s policy shifts but the second half of the year is likely to see strong Foreign Institutional Investor (FII) inflows in the Indian equity markets, says Harish Krishnan, Co-CIO and Head Equity, Aditya Birla Sun Life MF. He also says that 2025 will be a phase of market consolidation with fewer stocks participating in market gains and investors can expect the returns to be between 8-12 per cent, with valuations looking reasonable in large caps than mid and small caps.

Among sectors, investors can focus on rising sectors like private banks, energy proxies, cement, and metals, while business momentum is seen in consumer durables, IT and capital goods. Conversely, real estate, defence/PSU stocks are some sectors to be wary of, says Krishnan while addressing the media at the market outlook meet of ABSL MF.

The fund house also thinks that with interest rates expected to decline, growth stocks may outperform value stocks. It also said, “Looking ahead, asset allocation strategies are expected to yield steady returns across different asset classes. Fixed income investments are projected to deliver returns in the range of 8-9 per cent, while precious metals like gold and silver are forecast to generate returns between 8-12 per cent.” Overall, the global and Indian macroeconomic environment presents a mix of risks and opportunities. India’s growth story remains intact.

“Looking ahead, profit growth is expected to align more closely with revenue growth, with corporate earnings projected to grow in the low-to-mid teens over the next three years, particularly among BSE100 companies. Despite relatively low foreign FPI positioning in India compared to other emerging markets, Indian households continue to embrace the 'buy the dip' mentality, driving market resilience.” says ABSL MF.