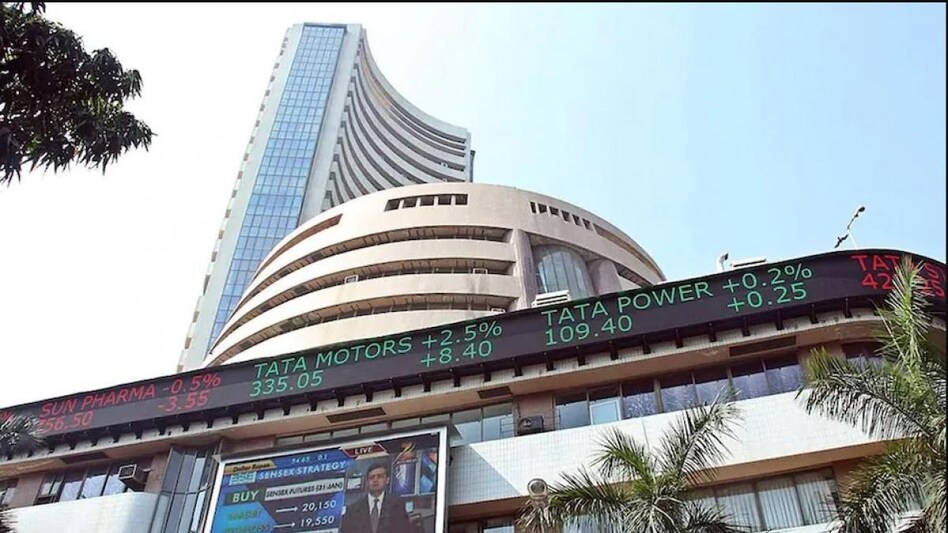

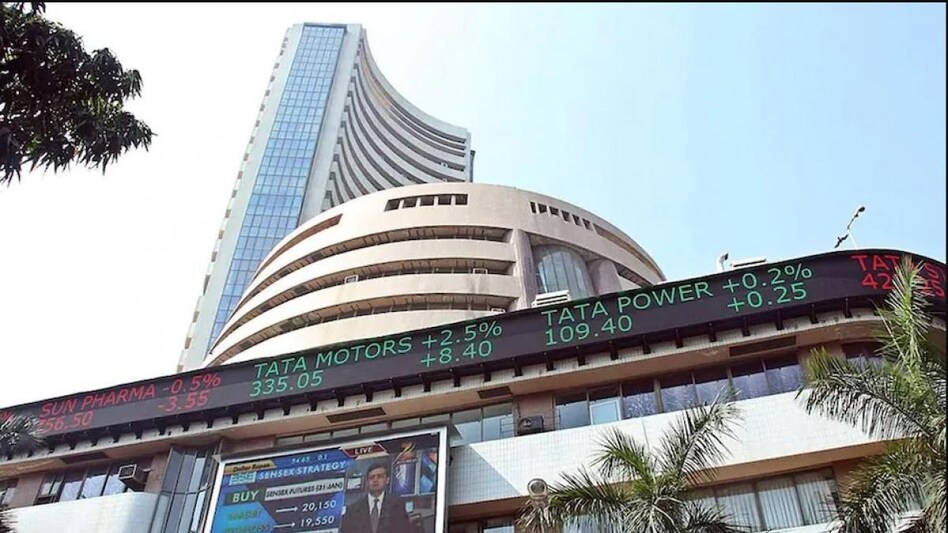

Share Market Live: Tracking Sensex, Nifty today

Share Market Live: Tracking Sensex, Nifty today

Share Market Live: Tracking Sensex, Nifty today

Share Market Live: Tracking Sensex, Nifty today The Indian market closed higher today. Sensex rose 760 points to 54,521 and Nifty closes 230 points higher at 16,280. Sensex gained 344 points to close at 53,760 and Nifty rose 110.55 points to 16,049.20 in the previous session. Hindustan Unilever, Titan, Maruti, Larsen & Toubro, HDFC, Mahindra & Mahindra, Nestle and Bharti Airtel were the top Sensex gainers, rising up to 2.87 per cent.

Tata Steel, Power Grid, HCL Technologies, Wipro, Dr Reddy's and Axis Bank were the top Sensex losers, falling up to 2.70 per cent.

Stocks In News: HDFC Bank, JSPL, Tata Steel, Vedanta and more

Here's a look at live market updates today.

3:37 pm: Sensex rises 760 points to 54,521 and Nifty closes 230 points higher at 16,280.

3:05 pm: Sensex rises 754 points to 54,515 and Nifty gains 232 points to 16,281 in the afternoon session.

2:33 pm: Tata Steel stock rises on Rs 12,000-crore capex plan

Shares of Tata Steel rose over 2 per cent today after the firm said it has planned capital expenditure (capex) of Rs 12,000 crore on its India and Europe operations during the current financial year.

Tata Steel stock touched an intraday high of Rs 906.55 against the previous close of Rs 883.60 on BSE today. It also touched an intraday low of Rs 892.25 on BSE.

Tata Steel shares were trading higher than 20 day moving averages but lower than 5 day, 50 day, 100 day and 200 day moving averages.

1:50 pm: PritiHome to invest Rs 3 crore to set up 5 offline stores

Home furnishing startup PritiHome said it would invest over Rs 3 crore to open five stores in four states by the end of this financial year. The first offline store will come up in Jodhpur, Rajasthan, next month, while the second store will be opened in Pune (Maharashtra) by October. It will open stores in Bangaluru (Karnataka) and Hyderabad (Telangana) later. At present, the company offers interior collections for homes through its e-commerce platform.

1:16 PM: HDFC Bank shares: Check the new target price post Q1 earnings

Shares of HDFC Bank were trading lower today after the private sector lender reported a 20.91 per cent rise in its June quarter net profit. HDFC Bank stock fell up to 1.60 per cent to Rs 1,342 against the previous close of Rs 1,363.85 on BSE. HDFC Bank shares are trading higher than 50-day moving averages but lower than 5-day, 20-day, 100-day and 200-day moving averages .

The large cap stock has lost 11.66 percent in a year and fallen 9.16 per cent in 2022. Total 9.62 lakh shares of the firm changed hands amounting to a turnover of Rs 130.65 crore on BSE. The market cap of the firm fell to Rs 7.46 lakh crore on BSE.

The stock hit a 52-week high of Rs 1,724.30 on October 18, 2021 and a 52-week low of Rs 1,271.75 on June 17,2022. The lender's net profit climbed 20.91 per cent to Rs 9,579.11 crore in the June quarter.

12:23 pm: Market update

Sensex rises 590 points to 54,351 and Nifty gains 171 points to 16,220.

11:53 am: Voltas stock rises 4% on record AC sales in H1 2022

Shares of Voltas rose nearly 4 per cent today after the Tata group firm said it sold close to 1.2 million units of residential ACs in the first half of 2022, clocking a 60 per cent growth led by an intense summer and expansion of sales network. Voltas stock gained 3.85 per cent to Rs 1021.20 against the previous close of Rs 983.30 on BSE. Voltas is trading higher than the 5-day, 20-day and 50-day moving averages but lower than 100-day and 200-day moving averages.

11:44 am: Market update

Sensex rises 511 points to 54,271 and Nifty gains 156 points to 16,205.

10:28 am: Angel One Q1 performance

Angel One reported a 49.6% rise in consolidated net profit to Rs 181.51 crore on a 44.69% increase in total income to Rs 686.53 crore in Q1 FY23 over Q1 FY22. The company said that it continued to witness strong gross addition of 1.3 million clients in Q1 FY23, crossing 10 million client mark during the quarter. Total client base was 10.4 million in Q1 FY23, up 13% QoQ and 96.9% YoY. The firm's overall retail equity turnover market share stood at 20.8% in Q1 FY23, down 21 bps QoQ.

10:19 am: Just Dial shares fall over 4% after Q1 loss widens to Rs 48.36 cr

Shares of Just Dial fell over 4 per cent in early trade after the local search platform's consolidated loss widened to Rs 48.36 crore in the quarter ended June 30, 2022 against a loss of Rs 3.52 crore in the corresponding period a year ago.

Just Dial stock opened with a loss of 2.3 per cent at Rs 564.50 against the previous close of Rs 577.80 on BSE. Later, the share fell 4.43 per cent to Rs 552.20. Just Dial shares are trading lower than 5-day, 20-day, 50-day, 100-day and 200-day moving averages.

The small cap stock fell over 48 per cent in a year and lost 31.46 per cent in 2022.

9:17 am: Sensex rose 427 points to 54,187 and Nifty gained 144 points to 16,193 in early trade.

9:10 am: V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

"High volatility in the market is likely to continue in the near-term with erratic action from FIIs (FIIs bought on 3 days this month and sold on other days) and sustained buying on dips by retail and DIIs. A significant market trend is the change in leadership from IT and banking to consumption driven FMCG and autos. The 6-month Nifty IT index return is - 31.79% and the Nifty Bank Index is down 9.61% during this period. In sharp contrast to this, Nifty FMCG Index is up 9.74% and Nifty Auto Index is up by 6.17% during this period. IT is weak on fears of a possible US recession impacting tech spending by companies. Leading bank stocks are weak due to sustained FII selling, in spite of their improving fundamentals. FMCG and autos are benefiting from the recent commodity price crash. Capital goods also are doing well on improving capex prospects. Investors can consider slightly restructuring their portfolios in the light of the leadership changes in the market."

8:34 am: Expert take

Siddhartha Khemka, Head - Retail Research, Motilal Oswal

"On the domestic front, monsoon is progressing well with rains being 13% surplus which can boost rural economy. As the results season gains momentum, more stock specific action would be seen in the market. Going ahead, market is likely to continue its range bound movement as the tug of war continues between global and domestic cues."

8:20 am: SGX Nifty

The Indian market is likely to open higher today as SGX Nifty rose 153 points to 16,193. The Singapore Stock Exchange is considered to be the first indication of the opening of the Indian market.

8:15 am: Market on Friday

Benchmark indices snapped four days of losing streak led by gains in auto, capital goods and consumer durables shares. Sensex gained 344 points to close at 53,760 and Nifty rose 110.55 points to 16,049.20. Hindustan Unilever, Titan, Maruti, Larsen & Toubro, HDFC, Mahindra & Mahindra, Nestle and Bharti Airtel were the top Sensex gainers, rising up to 2.87 per cent. Tata Steel, Power Grid, HCL Technologies, Wipro, Dr Reddy's and Axis Bank were the top Sensex losers, falling up to 2.70 per cent.