The investment scenario has

been buoyant in 2012. The domestic stock market is going strong. Commodities and debt, too, have given decent returns to investors.

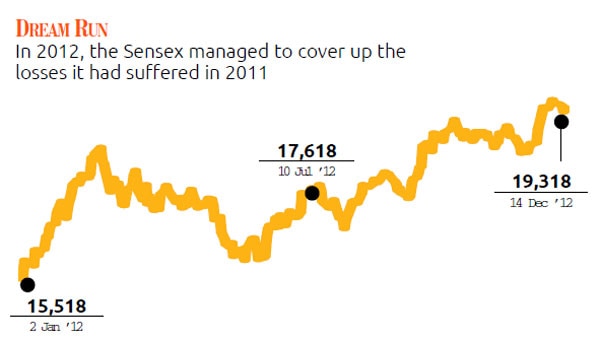

During the year, the government woke up from its slumber and put economic reforms back on track, giving investors hope. As we enter the New Year, the Bombay Stock Exchange

Sensex is not far from its all-time high of 21,000. It is set to close the year just a few hundred points from the 20,000 mark.

A slight nudge can create a new landmark. There is also hope that commodities, including gold and silver, will continue to give decent returns. Debt, of course, will be the preferred option for the risk-averse. And then there is real estate, which always promises to add to your wealth.

Should you invest in equity? If yes, in which stocks? Is there steam left in the yellow metal, which has had a dream run over the past five years? Will debt do well as the interest rate cycle looks set for a reversal, pushing up bond prices? Real estate returns were moderate in 2012. What about 2013?

Knowing where to invest is knowledge and knowing

when to invest is an art which cannot be mastered. That's why wealth managers have arrived at a "spread it as you build it" approach. Managing wealth has become as difficult as creating wealth given the volatile nature of most assets.

MONEY TODAY tells you what to expect in 2013 and how to build and protect wealth next year.While the approach to investments should depend on your goals and risk-taking ability, there are a few major events which one needs to look at before taking a plunge into any asset class. The Union Budget next year, introduction of the direct taxes code, macro issues such as inflation and high fiscal deficit, stock valuations and depreciating rupee will define people's investment choices next year.

In addition, the situation in Europe and the US as well as the political unrest in West Asia will play an important role in deciding whether the global flush of liquidity enters the Indian markets and impacts returns from different asset classes.

But one thing is sure - the

markets will continue to remain volatile.

"The new year will be challenging. Every aspect, be it the fiscal condition, monetary policy, inflation, credit growth or currency movements, has a lot of challenges. Some issues, such as inflation, are structural, whereas some can be resolved through reforms," says Rajesh Iyer, head, products and research, Kotak Wealth Management.

Against this backdrop, we spoke to

some of the country's top wealth managers to understand the best investment options in the coming year.

BET ON DEBTWith widespread expectation that the Reserve Bank of India, or RBI, will lower interest rates by cutting the repo rate, at which it lends to banks,

debt could be the most important component of your portfolio in 2013.

Besides providing safety, it could give good returns as well, as any rate cut will push up the demand for higher-coupon debt instruments and increase the value of the current bonds with high coupon rates. Thus, bond-holders are likely to gain from capital appreciation. This, say experts, will be especially beneficial for those who invest in bond funds at this stage. As yields come down with the fall in rates, the net asset values of their funds will rise as bonds held by them command a higher value in the market.

"A good deal of attraction towards debt is because interest rates appear to be on a declining path. There is also the plain vanilla attractiveness of higher coupon rates and potential appreciation in the bonds' market rate," says Satya Bansal, chief executive, Barclays Wealth and Investment Management.

"More and more investment is happening in long-duration debt, be it corporate bonds or tax-free bonds of long durations like 15-20 years," says Bansal.

Agrees Iyer of Kotak, "As of today, from a risk-reward point of view, debt looks a little better compared to equities, commodities and real estate. From a long-term view, you are getting about 9 per cent for the next ten years. So it makes sense to hold on to long-term bonds

But the question most people ask is that what is the ideal allocation towards debt? Sunil Mishra, CEO of Karvy Private Wealth, says high networth individuals can think of setting aside 40 per cent surplus for debt while other retail investors should restrict themselves to 30 per cent.

EASY ON EQUITYThough equity must continue to remain a key ingredient in your portfolio, wealth managers suggest caution on this front. "In the long run, you cannot stay in debt for long since you need to beat inflation. That's why equity is a key ingredient," says Bansal.

There are chances that

Indian equity may outperform others because global liquidity will chase economies which still promise decent growth and any positive news from the government in terms of fiscal numbers, clearance of pending bills and lower inflation will direct money into Indian equity markets.

However, investors should take informed decisions since the equity market is highly risky. Iyer of Kotak says he prefers to look at individual stocks rather than investing on the basis of sectors that are likely to perform well. Also, one needs to look at valuations.

"We are looking at the market with a bottoms-up approach rather than being sector-specific. A portfolio should ideally have a combination of mid-cap and large-cap stocks," he says.

Mishra of Karvy suggests that retail investors can look at allocating 50 per cent funds to equity.

ADDING SHINESince equity will continue to remain volatile, one can add

balance to the portfolio by adding gold as a hedge against possible losses. "If you have equity in your portfolio, you need to have gold as well," says Iyer of Kotak Wealth. It's not a direct hedge, but if something goes wrong, depreciation of the currency will be the order of the day, against which gold will be a hedge, he says.

But whether gold gives decent returns will be decided by other factors such as the situation in the western economies, liquidity in global markets on account of loose monetary policies followed by governments to reverse the economic slowdown and the value of the rupee.

"Since the rupee has depreciated against the dollar, gold prices have gone up. Going forward, gold prices will decline in the local market irrespective of what happens internationally. There may be appreciation of gold prices internationally, but if the rupee appreciates, prices will decline locally," says Bansal of Barclays.

According to Mishra of Karvy, retail investors should park at least 20 per cent funds in gold. This figure is 10 per cent for high networth individuals or HNIs.

HOME TRUTHSWealth managers expect real estate prices to correct given the weak economic conditions and tight liquidity. "We are passing through a liquidity tightening cycle in real estate. How much correction will happen and when is a question of debate. Also, correction may happen only in areas where supply is not a constraint. In areas where supply is limited, prices may not fall," says Bansal. One can also look at commercial properties for good rental returns. Depending on the areas, rental income can range from 8-11 per cent of the property's value, says Iyer of Kotak. In comparison, the rental yield of residential properties in India is 3-5 per cent. With a longterm view, one can also benefit from capital appreciation.

Sunil Mishra of Karvy Private Wealth says 20 per cent assets can be parked in real estate, excluding the primary residence.

Another option for the rich is the high-yield debentures offered by property developers. "Typically, these debentures, which are secured against projects, offer a yield of 16-21 per cent. People are increasingly looking at this option but are showing more interest in rent-yielding commercial assets," says Iyer.

QUERY CORNER (Answered by Sunil Mishra, CEO, Karvy Private Wealth)

MUTUAL FUNDS

Vinod Kumar Jain from Delhi

A. It depends on the risk tolerance of the investor. For an aggressive investor, increasing allocation to mid- and small-cap funds is suggested, while for a conservative investor with moderate risk tolerance, higher allocation to multi- or large-cap funds is recommended.

Q. In the debt category, what kind of funds can investors choose with interest rates likely to come down from next year?A. Long-term debt funds, while being available at attractive yields, provide an opportunity for capital appreciation due to the fall in interest rates. Hence, these are suitable for those who want to stay invested for the medium term (exiting when prices appreciate) as well as those who want to earn high yields for a long period.

EQUITY

Manmohan Bairathi from Delhi

A. We are expecting 12% growth in earnings in 2012-13 and 14% in 2013-14. With the broader market trading at 13 times 2013-14 earnings, equity valuations in India are still at attractive levels.

With the worst behind us, we believe there is a good case for increasing allocation to equity.

Q. Economic reforms benefitted some sectors in 2012. How are they likely to perform in 2013? Also, is it the right time to invest in mid-cap stocks?A. We believe that the steps taken by the government on the fiscal front will give the RBI cushion to cut policy rates in January. It will also help in reviving growth. There are enough beaten-down mid-cap stocks which have the potential to deliver better returns than the broader market. One just has to identify them.

QUERY CORNER (Answered by P.E Mathai, CEO, Muthoot Precious Metals Corporation)

COMMODITIES

Luv Dhingra from Noida

Q. What is the best way to invest in this commodity - gold exchange-traded funds, e-gold or physical gold?

A. The markets are volatile and the value of rupee has fallen. So, it is good time to invest in gold as there is a likelihood that its price will go up further in 2013.

Indians have a leaning towards physical gold. Today, buying physical gold doesn't necessarily mean a hefty investment. The metal can be bought in varied denominations and through the monthly instalments schemes offered by jewellers, banks and NBFCs. Gold coins are also attractive as their purity is assured and they can be bought in small denominations. E-gold is more costeffective for people who have a long investment horizon, as it has low currency risk and involves no management or other recurring expenses. However, you should have a demat account to trade in e-gold.

QUERY CORNER (Answered by Anil Rego, CEO and Founder, Right Horizons)

DEBT

Risheshwar Sahai Saxena from Bangalore

A. Further softening of interest rates may lead to a fall in fixed deposit (FD) rates. So, those who are looking for regular and secure income, especially senior citizens, FDs are a good option now.

Most banks offer 50 basis points higher interest rate to senior citizens.

However, the product is more suitable for people falling in the 10% tax bracket.

Post-tax returns on FDs are not that attractive for those who are in the higher tax brackets of 20% and 30%. Debt mutual fund schemes are a more taxefficient alternative.

Even for the conservative investor, it is important to diversify. Though it is advisable that you invest in low- to moderate-risk options, do not put all your money in debt. FDs can be used as one of the options to take care of the monthly expenses.