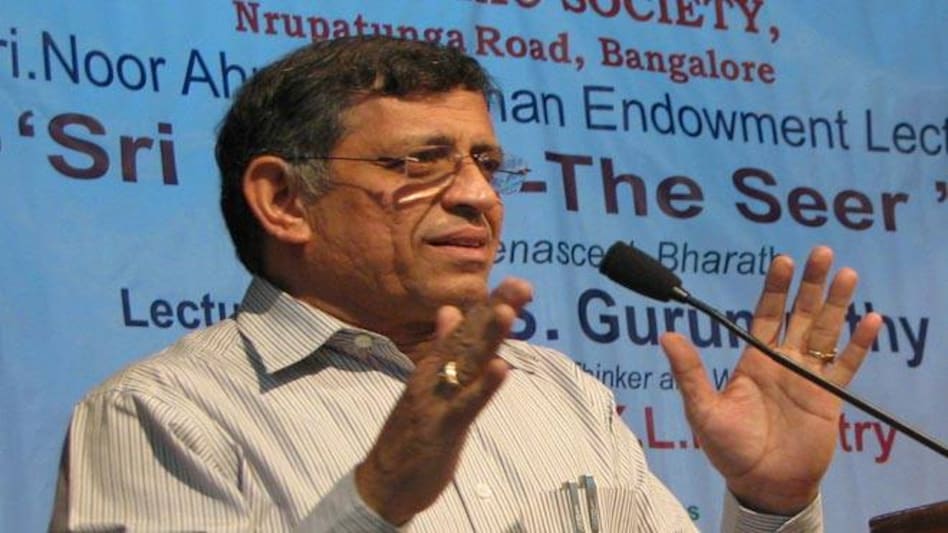

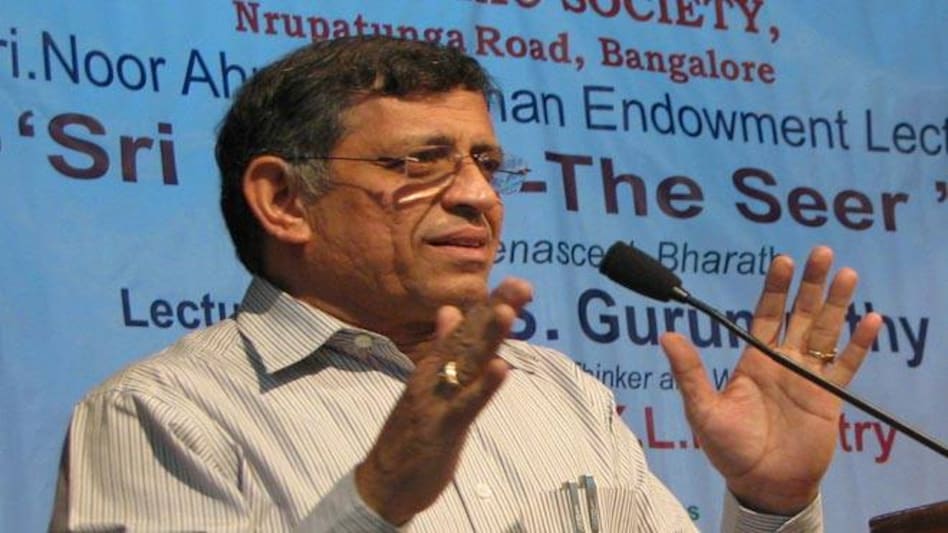

RBI board member S Gurumurthy on Thursday said the economy would have collapsed but for the November 2016 demonetisation because high denomination notes of Rs 500 and Rs 1,000 were being used to purchase real estate and gold.

In a shock decision, the government had demonetised old Rs 500 and Rs 1,000 notes on November 8, 2016, with, an aim to check black money, terror financing and promote digital transactions, among others.

"In just 18 months prior to demonetisation, 500 rupee, 1,000 rupee (notes) rose to 4.8 lakh crore that is what funded the real estate and gold prices and we would have gone the same way, (as what happened in) 2008 in the US due to sub-prime lending.

"But for demonetisation, the Indian economy would have collapsed. It was a corrective measure," Gurumurthy said in a lecture at Vivekananda International Foundation here.

Replying to a question, he said it is unfortunate that economists and intellectuals have not taken the right position on demonetisation and GST.

".. it is not an economic discourse. It has become a political and ideological discourse I ... this is the matter for the ruling party to convince the people and the opposition party to convince the people..," he added.

Referring to non-performing assets in the banking sector, Gurumurthy said it was a result of lending driven by the excessive flow of foreign exchange during the 2004-10 period.

Even former RBI Raghuram Rajan admitted that excessive lending which took place during that time resulted in bad loans, he added.