‘Major development’: Hindenburg founder responds to report of US authorities' probe into Adani Group

‘Major development’: Hindenburg founder responds to report of US authorities' probe into Adani Group

‘Major development’: Hindenburg founder responds to report of US authorities' probe into Adani Group

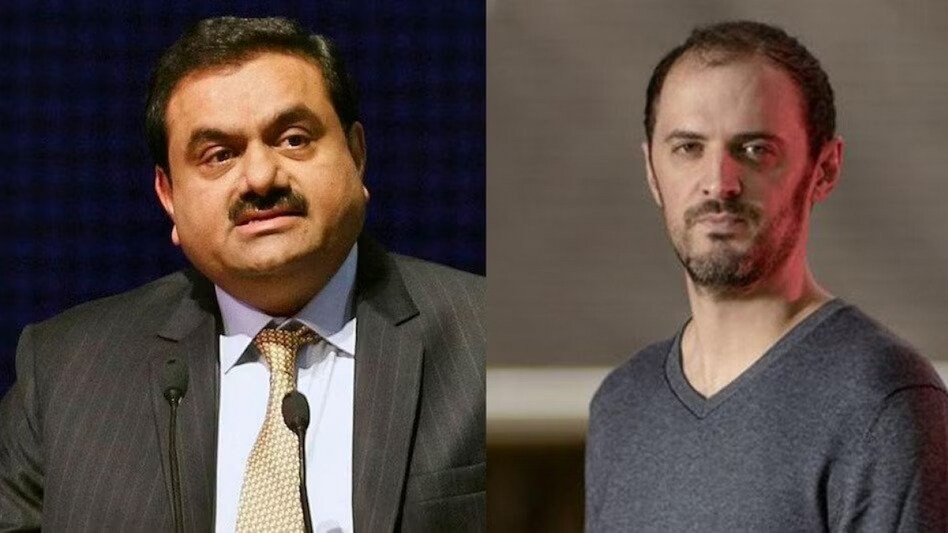

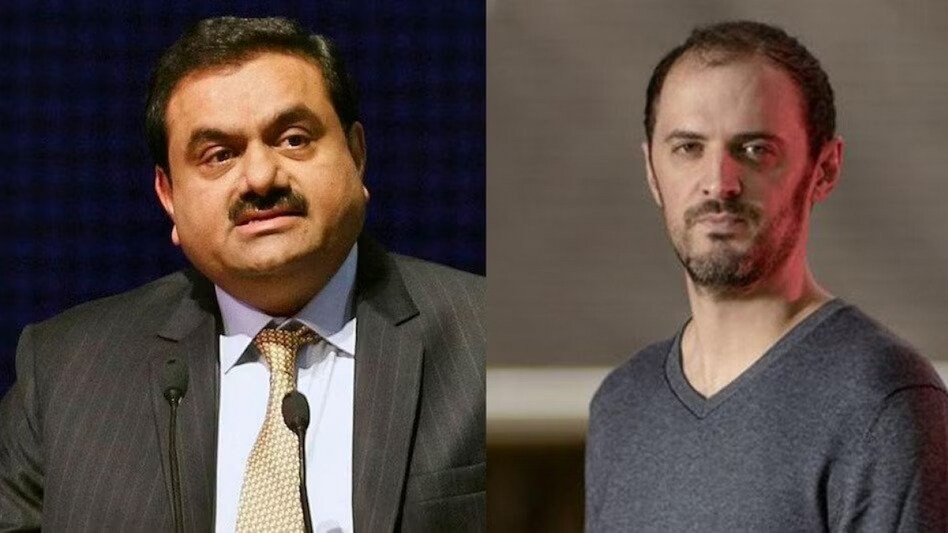

‘Major development’: Hindenburg founder responds to report of US authorities' probe into Adani GroupUS authorities on Friday said that they are investigating the representations made by the Adani Group to its American investors, in response to a report by the short seller Hindenburg Research, accusing the conglomerate of stock manipulation and accounting fraud.

According to a report by Bloomberg, the US Attorney's Office in Brooklyn, New York, has sent inquiries to institutional investors who hold significant stakes in the Adani Group, focusing on the information provided by the conglomerate to those investors.

The Securities and Exchange Commission (SEC) is also conducting a similar investigation, according to sources familiar with the matter.

The founder of the Hindenburg research, Nate Anderson, shared the report by Bloomberg and wrote on Twitter, “Major development: The U.S Department of Justice and the SEC are probing Adani. Both agencies are said to be scrutinising Adani’s disclosures to investors.

This scrutiny from US authorities adds to the existing regulatory investigations being faced by the Gautam Adani-led Adani Group in India.

The inquiries by US authorities come at a time when Indian Prime Minister Narendra Modi is on a state visit to US.

On Friday, Adani Group's market capitalisation fell as much as Rs 55,000 crore, its biggest single-day drop in m-cap in four months.

A spokesperson for the Adani Group stated that they were not aware of any subpoenas issued to investors. The group denied the accusations made by the short seller and maintained that their disclosures were comprehensive and accurate.

“Our various issuers groups remain confident that the disclosures are full and complete as disclosed in the relevant issuer offering circulars,” said a spokesperson of the Adani Group.

The troubles for the Adani Group began when Hindenburg Research released a report on January 24, accusing the conglomerate of using offshore companies in tax havens to manipulate share prices and financial results. The report also alleged non-compliance with disclose and shareholding laws.

Despite the group’s strong denial of the accusations, the release of the report led to a significant decline in Adani Group’s share prices, resulting in a substantial loss of market value. At one point, the stocks wiped out as much as $153 billion off the combined market value of Adani Group’s 10 publicly traded businesses.

Watch: Amul Girl creator Sylvester daCunha passes away, throwback to iconic Amul Ads

Also Watch: Buzzing stocks on June 26, 2023: ICICI Securities, Shree Cement, Mazagon Dock, Policybazaar, others