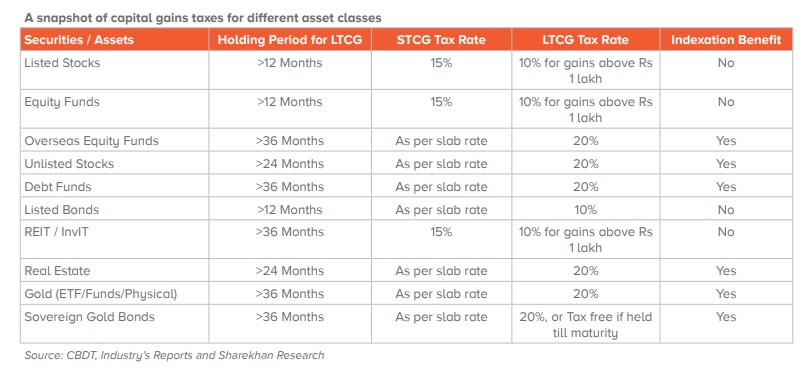

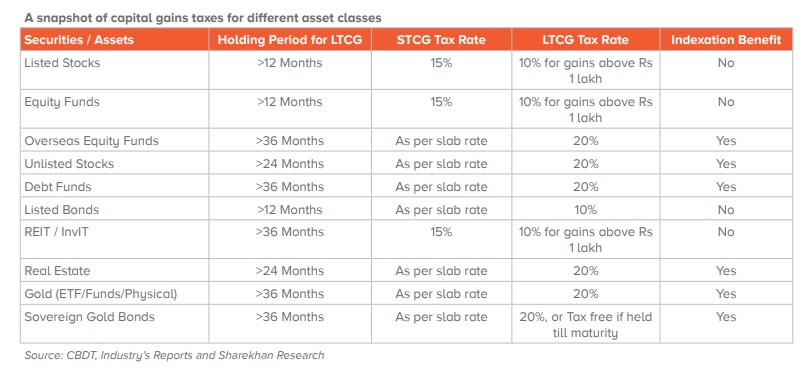

Equities attract 10 per cent LTCG tax, without indexation. For debt mutual funds and real estate, long-term capital gains are taxed at 20 per cent with indexation, analysts noted.

Equities attract 10 per cent LTCG tax, without indexation. For debt mutual funds and real estate, long-term capital gains are taxed at 20 per cent with indexation, analysts noted.

Equities attract 10 per cent LTCG tax, without indexation. For debt mutual funds and real estate, long-term capital gains are taxed at 20 per cent with indexation, analysts noted.

Equities attract 10 per cent LTCG tax, without indexation. For debt mutual funds and real estate, long-term capital gains are taxed at 20 per cent with indexation, analysts noted.Finance Minister Nirmala Sitharaman will announce the Union Budget 2023 shortly. Stock investors would keenly be following announcements regarding the long-term capital gains (LTCG) on equities. There are expectations that the FM could tweak LTCG tax rate or the holding period for stock investments, to be considered as long term. If that happens, a short-term market volatility is likely, analysts said.

The government could take steps towards rationalising LTCG on equities to make it homogenous across asset classes including debt and property, said Nuvama Institutional Equities. It noted that LTCG applies to equity investments on a holding of one year or above. For debt mutual funds, that holding period is three years or above; for property, the holding period is two years or above.

"From the capital market perspective, changes in the capital gains tax structure could create immediate volatility in the market. As per the general consensus this time around, the government can possibly look at uniformity across similar asset classes especially in terms of holding period, tax rate, among others. In our view, uniformity in holding period for LTCG looks more possible," Sharekhan said.

To add to this, tax rates are different across asset classes. Equities attract 10 per cent LTCG tax, without indexation. For debt mutual funds and real estate, long-term capital gains are taxed at 20 per cent with indexation.

"Some rationalisation with regard to tax rates or holding period may be in the offing," Nuvama said adding that LTCG tweaks may create short-term volatility.

If the holding period on equity investments is increased or LTCG rate is increased, it can have a negative impact on markets, said Quantum Securities. HDFC Securities expects the FM to leave capital gains taxation unchanged.

Meanwhile, the LTCG tax on unlisted stock held for more than 24 months is double that of listed equity shares held

for a year. Unlisted stocks attracts LTCG of 20 per cent against 10 per cent for listing stocks. There are hopes that the LTCG tax on unlisted shares could be brought down to 10 per cent level.

Also read: Budget 2023: 5 things that stock investors are looking for