ITC shares are trading higher than the 5 day, 10 day, 20 day, 30 day, 50 day, 100 day and 200 day moving averages.

ITC shares are trading higher than the 5 day, 10 day, 20 day, 30 day, 50 day, 100 day and 200 day moving averages.

ITC shares are trading higher than the 5 day, 10 day, 20 day, 30 day, 50 day, 100 day and 200 day moving averages.

ITC shares are trading higher than the 5 day, 10 day, 20 day, 30 day, 50 day, 100 day and 200 day moving averages.FMCG major ITC Ltd has received an upward revision in target price by Sharekhan, as the brokerage believes the cigarette maker is entering into a consistent earnings growth trajectory with the core cigarette business and non-cigarette FMCG business expected to post steady performance, while it also sees a recovery in paperboard, paper & packaging (PPP) business in the quarters ahead.

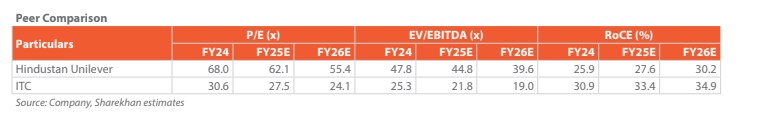

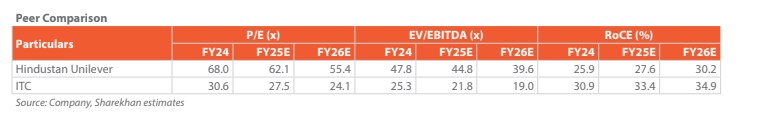

Sharekhan said after the demerger of the asset-heavy hotels business, the return profile of ITC will substantially improve in the coming years. "Discounted valuations of 24 times/22 times its FY2026/27E EPS and consistent earnings growth visibility makes it a preferred pick in the consumer goods space," Sharekhan said. The brokerage suggested a target price of Rs 595 on the ITC stock.

On Tuesday, the FMCG stock was trading 0.66 per cent lower at Rs 508.70. ITC's target price suggests a 17 per cent upside potential over this price. ITC's cigarette business achieved steady volume growth of mid-to-high single digit in the past. With the tax rate on cigarettes kept unchanged in the Union Budget 2024, Sharekhan expects cigarette volumes to grow 5 per cent in the near term.

"With strategies in place, the non-cigarette FMCG business has a strong potential to grow by low to mid-teens with Ebitda margins improving by 80-100 bps per annum in the near term," the brokerage said.

It cited that ITC’s non-cigarette FMCG business revenues grew 10 per cent while its Ebitda margins rose 100 bps to 11.2 per cent in FY2024. In a tough demand environment, PPP business performance was affected by low priced Chinese supplies in the global markets, muted domestic conditions and surge in wood prices, i said.

ITC, Sharekhan said, expects demand to recover prior to festive season. The brokerage expects ITC’s earnings to grow in double digits over the next two years.

"ITC's valuations at 24 times/22 times its FY2026 and FY2027 earnings is at a discount as compared to large peers," the brokerage said.