Mobile banking is becoming more and more prevalent in India thanks to its convenience. Month-on-month transactions carried out through mobile banking are surging both in volume and value terms.

Source: RBI

According to

Reserve bank of India (RBI) data, a total of 3.7 crore mobile transactions took place between February and November 2012, jumping around 1.7 times in volumes over this 10-month period. These transactions saw nearly a three-fold increase in value over the same period.

Increasing smartphone adoption and initiatives such as media promotions and customer education programmes for mobile banking have led to this uptrend. For customers, mobile banking is convenient while banks benefit through a low-cost channel.

The SBI group dominates this space in volume terms with an overall share of 67.4 per cent in total volumes. Private and foreign banks follow, with an overall share of 30.1 per cent in November.

Source: RBI

However, the SBI group has a lower share in value terms compared to the private and foreign banks. "In an evolving market, which is in its nascent stage, these developments are bound to happen when more banks get into the space," said an official from the bank, in an emailed response.

Among banks, SBI leads the race with 65.4 per cent share in the total number of mobile transactions carried out in November, followed by ICICI Bank with a 14.2 per cent share, Axis with 9.4 per cent and Citi bank with 3.5 per cent.

Source: RBI

Around three per cent of SBI's total customer base is into mobile banking transactions. For ICICI Bank, over 10 million customers have currently registered for mobile banking.

Prepaid mobile recharges, DTH recharges, ticket bookings (movies/travel) are among the fast growing transactions in mobile banking.

"With multiple modes of remittances being made available now, the number of fund-transfer transactions (P2P) is also increasing steadily," said the SBI email.

Currently there is no cap on per-day transactions for

encrypted transactions in banking channels, including mobile banking. These limits are set by individual banks depending on their risk perception of the respective channels. However, for unencrypted transactions, such as those through SMS, the RBI has set a limit of Rs 5,000 per day.

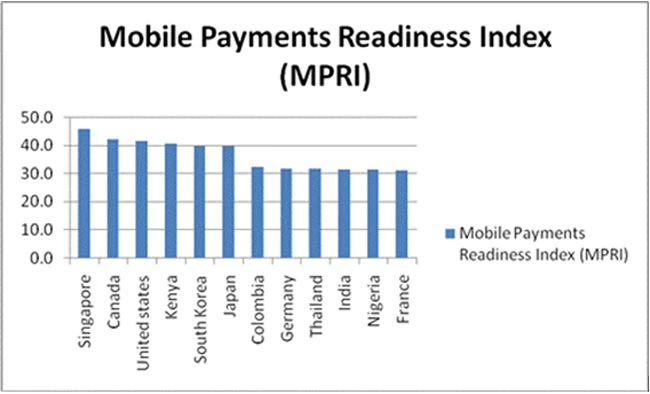

With mobile phone penetration of over 80 per cent, India has a huge potential for mobile banking. But on the global landscape, mobile payments have a long way to go in India. According to the MasterCard Mobile Payments Readiness Index (MPRI),

India ranked 21st among 34 countries with the score of 31.4 on a scale of 100. The index is a data-driven survey of the global mobile payments landscape. It relies on an analysis of 34 countries and their readiness to use three types of mobile payments: person to person, mobile e-commerce and mobile payments at the point of sale (POS).

The index also points out that consumers in India have not yet fully embraced mobile payments. Only 14 per cent of Indian consumers are familiar with both P2P and m-commerce transactions, and 10 per cent are familiar with POS transactions.

Singapore topped the charts with a score of 45.6 followed by Canada and the US with scores of 42 and 41.5, respectively.